SFFORMS.COM – SF 1094 Form – United States Tax Exemption Form – When it comes to taxes, no one likes to pay more than they have to. Luckily, the United States government provides various tax exemptions that can help reduce your tax liability. One of these exemptions is the SF 1094 form, also known as the United States Tax Exemption Form.

Download SF 1094 Form – United States Tax Exemption Form

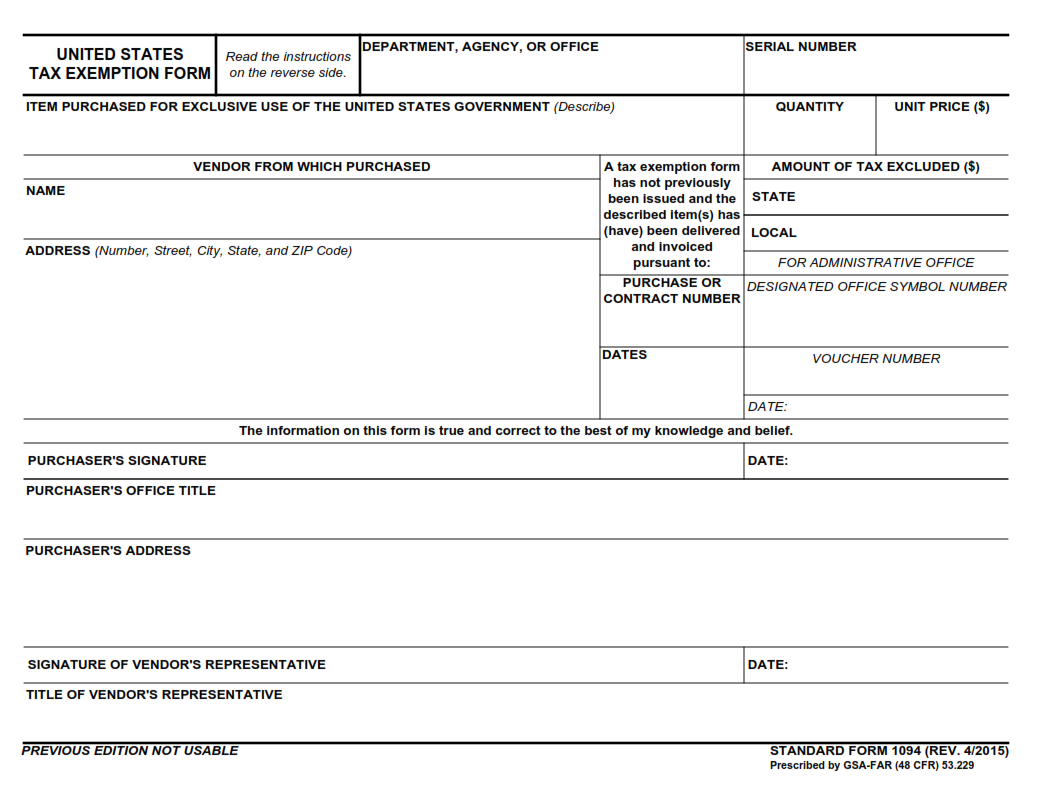

| Form Number | SF 1094 Form |

| Form Title | United States Tax Exemption Form |

| File Size | 1 MB |

| Date | 04/2015 |

What is a SF 1094 Form?

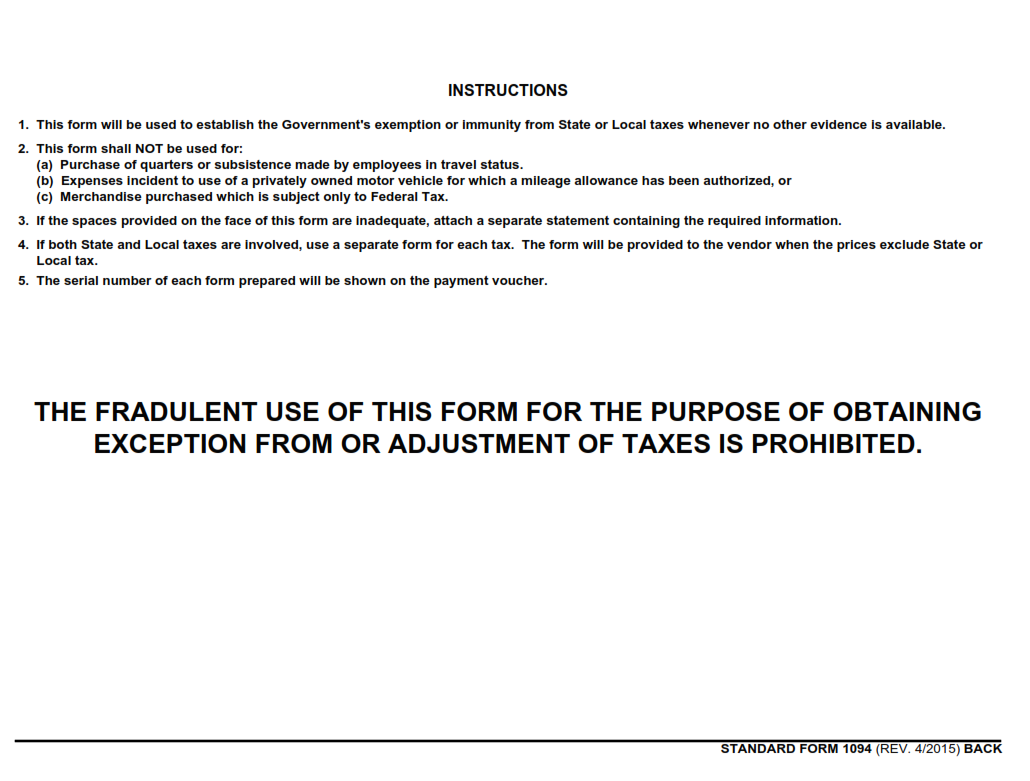

The SF 1094 Form is an important document for individuals and organizations seeking tax exemption in the United States. This form is specifically designed for non-profit organizations, charitable institutions, and other tax-exempt entities that are recognized by the Internal Revenue Service (IRS). The purpose of this form is to verify that these organizations meet the eligibility criteria for exemption from federal income tax.

To apply for tax exemption status using the SF 1094 Form, an organization must provide detailed information about its operations, governance structure, and financial activities. This includes information about any revenue generated by the organization, as well as details on how this revenue is used to further the organization’s mission. Additionally, the organization must provide a statement of its purpose and objectives that clearly outlines how it serves a charitable or public interest.

Once an organization has completed and submitted the SF 1094 Form, it will be reviewed by IRS officials who will determine whether or not it meets all of the eligibility requirements for tax exemption. If approved, the organization will receive official recognition as a tax-exempt entity under section 501(c) of the Internal Revenue Code. This can lead to significant financial benefits for eligible organizations including reduced tax liability and increased fundraising opportunities.

What is the Purpose of SF 1094 Form?

The SF 1094 form is a United States tax exemption form used by non-profit organizations. The purpose of the form is to request an exemption from federal income tax under section 501(c)(3) of the Internal Revenue Code. This section of the code allows for certain types of non-profit organizations, such as charities and educational institutions, to be exempt from federal income taxes.

To qualify for this exemption, an organization must meet specific requirements outlined in the Internal Revenue Code. These include being organized and operated exclusively for charitable, religious, scientific, or educational purposes as well as not engaging in any activities that are deemed illegal or against public policy.

The SF 1094 form serves as proof that the organization has applied for this tax-exempt status and has met all necessary requirements. Once approved by the IRS, the organization will be granted tax-exempt status and may then operate without paying federal income taxes on its revenue. This can provide significant financial benefits to non-profit organizations who rely on donations and other forms of support to carry out their mission.

Where Can I Find a SF 1094 Form?

The SF 1094 Form is a crucial tax exemption form that every U.S. citizen must fill out to claim their tax exemption status effectively. There are numerous places where you can find the SF 1094 Form, both online and offline. One of the most common ways to obtain this form is by visiting your local IRS office or calling their helpline number for assistance.

Additionally, the SF 1094 Form can also be found on various government websites, including the official IRS website, where you can download and print it out for free. It’s important to note that this form should only be filled out by individuals who are eligible for tax exemptions based on their current circumstances.

In conclusion, if you’re wondering where you can find an SF 1094 Form, rest assured that there are plenty of resources available at your disposal. Whether it’s through your local IRS office or online platforms such as government websites or other tax-related services, obtaining this essential form is a relatively simple process that shouldn’t take too much time or effort.

SF 1094 Form – United States Tax Exemption Form

The SF 1094 Form is the United States Tax Exemption Form issued by the Internal Revenue Service (IRS). This form exempts certain individuals and organizations from federal income tax liability. The IRS requires that all taxpayers who are subject to taxation submit a completed SF 1094 Form along with their annual tax return.

To be eligible for tax exemption, an organization must meet specific criteria set forth by the IRS. The criteria vary depending on the type of organization seeking exemption, but generally include factors such as having a charitable purpose, being organized as a nonprofit corporation, and not operating for profit. Once an organization has been granted tax-exempt status, it must maintain compliance with IRS regulations to retain its status.

If you believe your organization meets the criteria for tax exemption or need guidance on completing and submitting your SF 1094 Form, consult with a professional tax advisor or visit the IRS website for more information. Failing to comply with IRS regulations can result in significant financial penalties and may even jeopardize your organization’s eligibility for future exemptions.

SF 1094 Form Example