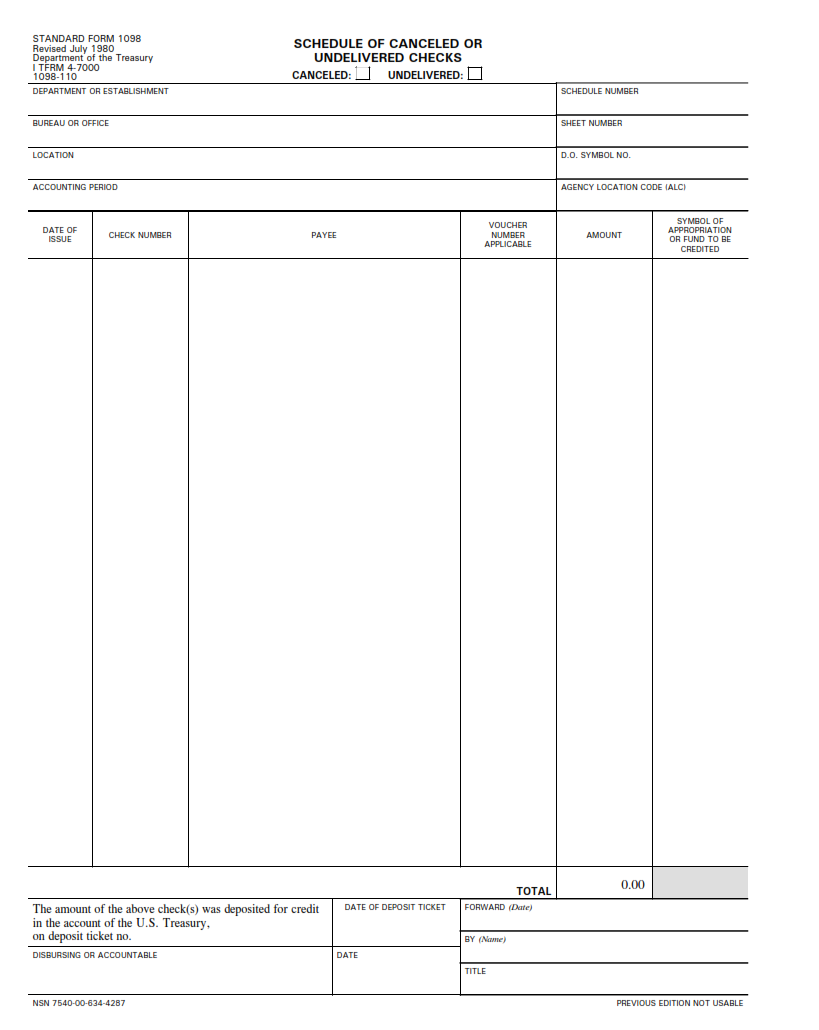

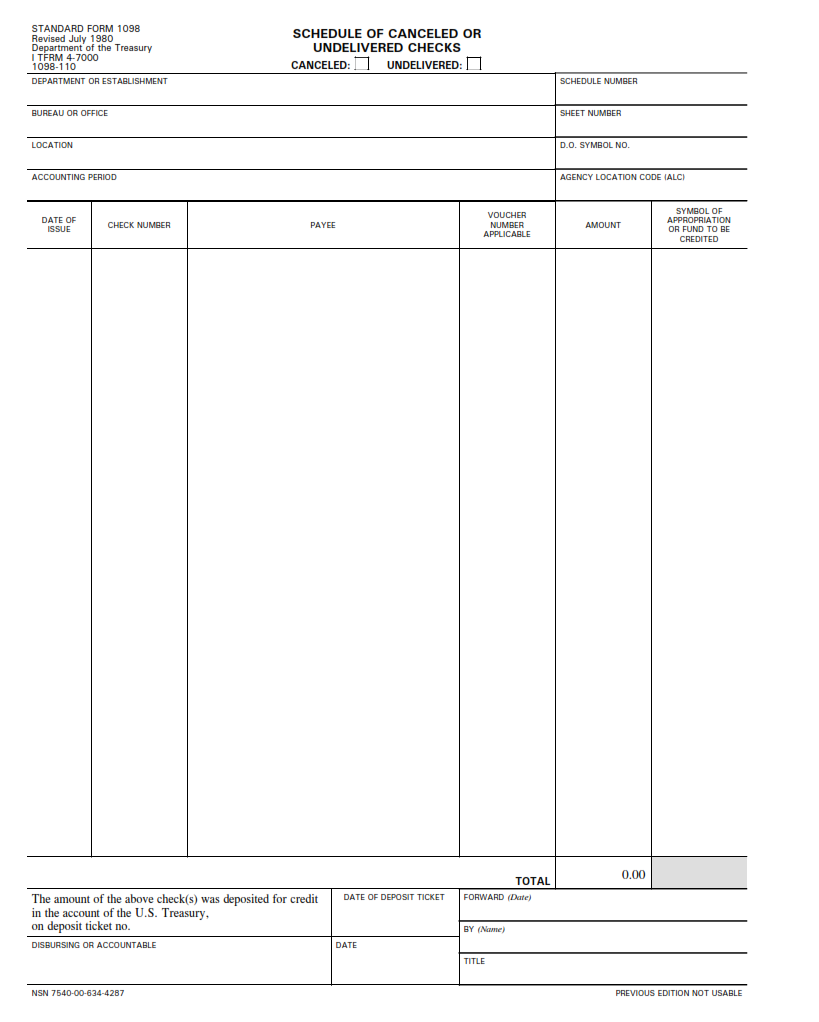

SFFORMS.COM – SF 1098 Form – Schedule of Canceled or Undelivered Checks – The SF 1098 Form, also known as the Schedule of Canceled or Undelivered Checks, is an important document used by businesses and individuals to report canceled checks that were never received by the payee. This form is typically filed with the Internal Revenue Service (IRS) and is required for those who have issued more than $600 in canceled checks during a tax year.

Download SF 1098 Form – Schedule of Canceled or Undelivered Checks

| Form Number | SF 1098 Form |

| Form Title | Schedule of Canceled or Undelivered Checks |

| File Size | 158 KB |

| Date | 07/1980 |

What is a SF 1098 Form?

The SF 1098 Form is a Schedule of Canceled or Undelivered Checks that provides information about canceled or undelivered checks for federal agencies. The form is used by federal agencies to report the status of all canceled or undelivered checks, including those that have been reissued and those that remain outstanding.

The purpose of this form is to provide a record of canceled and undelivered checks for audit purposes and to help ensure the integrity of government financial transactions. Federal agencies are required to submit this form annually to the Department of Treasury’s Bureau of Fiscal Service.

To complete the SF 1098 Form, federal agencies must provide information on each canceled or undelivered check, including its date, amount, payee name, check number, reason for cancellation (if applicable), and other relevant details. This information helps facilitate proper accounting procedures and minimizes fraudulent activities within government financial systems.

What is the Purpose of SF 1098 Form?

The SF 1098 form is a schedule of canceled or undelivered checks that are filed by federal agencies. The purpose of this form is to report the information on all canceled checks and undeliverable payments. This process helps in reconciling the account between the federal agency and its respective financial institution.

This form is crucial for ensuring accuracy in accounting records, as it provides a record of all canceled or undelivered payments. By filing this form, any discrepancies can be identified and resolved. Moreover, the data collected from this form can also be used for auditing purposes.

In conclusion, the SF 1098 Form serves as an important tool for maintaining accurate accounting records and ensuring accountability within federal agencies. It helps keep track of all canceled or undelivered payments, thereby reducing errors and improving transparency.

Where Can I Find a SF 1098 Form?

The SF 1098 form is an essential document that businesses and organizations use to keep track of their canceled or undelivered checks. This form helps them monitor the status of their transactions and payments, which is crucial for accounting and financial reporting purposes. However, finding a SF 1098 form can be a bit challenging, especially if you’re not familiar with the process.

One way to obtain a SF 1098 form is to contact your bank or financial institution directly. They may provide you with this form as part of their services or direct you to where you can download it online. Alternatively, you can also check with the Internal Revenue Service (IRS) website, which offers various tax forms including the SF 1098. You can either download it from their site or request a copy through mail.

In summary, obtaining a SF 1098 form requires some effort but it’s not impossible. Whether you choose to reach out to your bank or go directly through IRS channels, having this document will help streamline your accounting process and ensure that all canceled or undelivered checks are accounted for properly.

SF 1098 Form – Schedule of Canceled or Undelivered Checks

The SF 1098 Form is a document used by the federal government to report payments made towards mortgage interest. It is typically issued by lending institutions and sent to borrowers who have paid at least $600 in mortgage interest during the tax year. One section of this form, known as Schedule B, provides information on canceled or undelivered checks.

Schedule B of the SF 1098 Form requires lenders to report any checks that they have cancelled or failed to deliver. This can include situations where a borrower requested a check be cancelled, lost or destroyed checks, or even fraudulent activity. By reporting these cancelled or undelivered checks, lenders provide transparency and accountability in their financial transactions with borrowers.

It’s important for borrowers to review Schedule B carefully when receiving their SF 1098 Form. If there are any discrepancies or errors regarding cancelled or undelivered checks, they should contact their lender immediately to rectify the situation. Failing to address these issues could result in potential penalties from the IRS during tax season.

SF 1098 Form Example