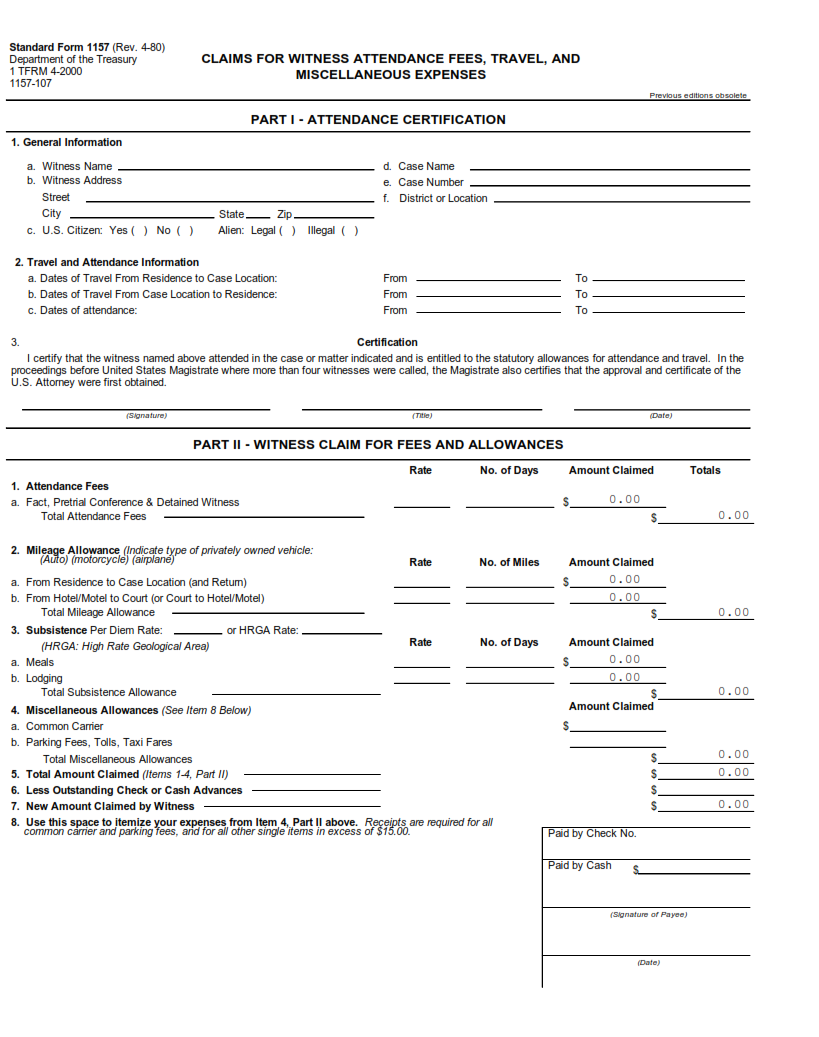

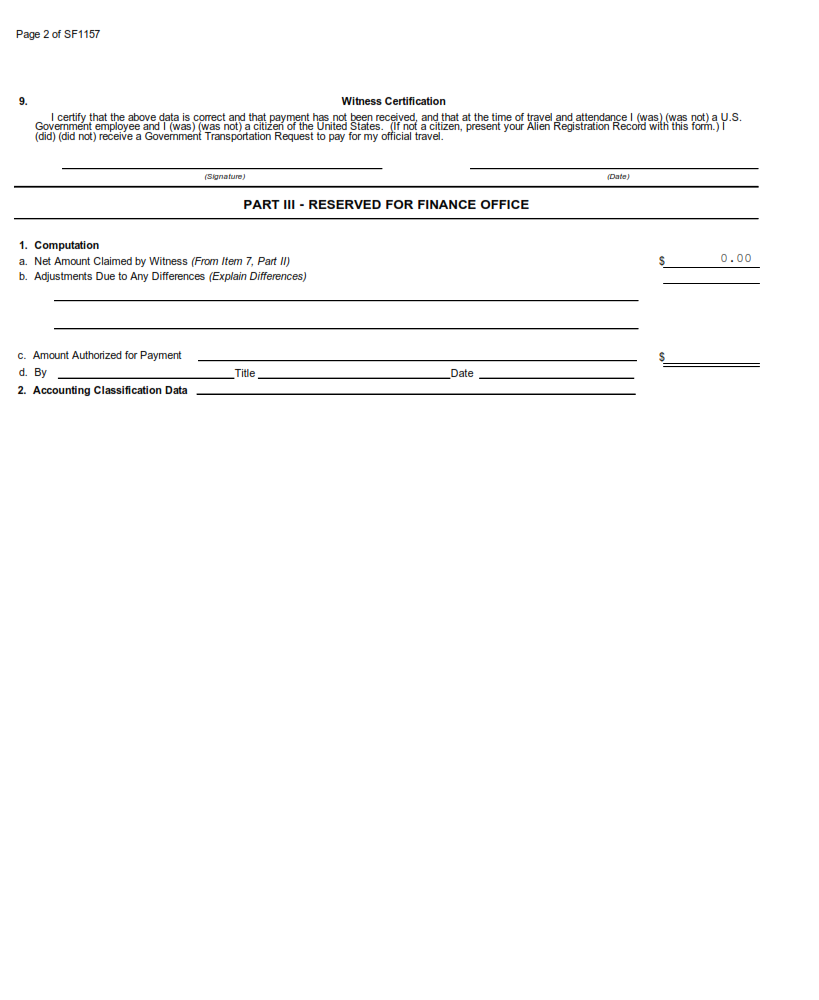

SFFORMS.COM – SF 1157 Form – Claims for Witness Attendance Fees, Travel, and Miscellaneous Expenses – The SF 1157 form is an essential document for those seeking reimbursement for witness attendance fees, travel expenses, and miscellaneous costs incurred during a legal proceeding. This form is used by individuals who have been called upon to provide testimony or evidence in court cases, administrative hearings, and other legal proceedings.

Download SF 1157 Form – Claims for Witness Attendance Fees, Travel, and Miscellaneous Expenses

| Form Number | SF 1157 Form |

| Form Title | Claims for Witness Attendance Fees, Travel, and Miscellaneous Expenses |

| File Size | 40 KB |

| Date | 04/1980 |

What is a SF 1157 Form?

The SF 1157 form is a document used by federal agencies to record time and attendance data for employees. The form tracks information such as employee work hours, leave taken, and other non-work periods such as training or travel. It is also used to document any overtime worked by an employee. The purpose of the SF 1157 is to provide accurate records of an employee’s time worked, which can be used for payroll processing and other administrative purposes.

The form itself consists of three parts: the first section is dedicated to recording basic information about the employee, including their name and job title. The second section documents daily work hours, leave taken, and any non-work periods during that pay period. Finally, the third section summarizes all recorded data for the entire pay period. This includes a total number of hours worked, overtime hours if applicable, and any accrued leave balances.

What is the Purpose of SF 1157 Form?

A SF 1157 Form is a document that is used by the government to record all of the details and facts surrounding an accident or injury that occurs on federal property. This form is a crucial part of keeping records for workers’ compensation and liability purposes. The form includes information such as names, addresses, phone numbers, and contact information for any witnesses or individuals involved in the incident.

The SF 1157 Form also requires detailed descriptions of what happened during the incident, including when it occurred, where it took place, and who was involved. Additionally, this form must include information about any injuries sustained by those involved in the accident or incident. All of this data helps ensure that those affected receive proper medical attention and compensation for their losses.

Where Can I Find a SF 1157 Form?

A SF 1157 Form is a vital document that serves as proof of income tax withholding and social security payments, which are made by federal employees. The form is commonly referred to as the Authorization for Disclosure of Salary and Wage Information, and it’s essential in ensuring that employees receive their expected benefits.

The SF 1157 Form provides detailed information about an employee’s salary and wage history, including their gross pay, deductions, and contributions towards various programs such as Medicare or retirement plans. This information can be helpful in determining eligibility for benefits or calculating future payouts.

Given the importance of this form, it’s crucial that federal employees keep accurate records of their earnings history. It’s also prudent to ensure that any changes in employment status or salary are promptly reported to relevant government agencies so that the correct information is reflected on the SF 1157 Form.

SF 1157 Form – Claims for Witness Attendance Fees, Travel, and Miscellaneous Expenses

A SF 1157 form is a document commonly used by government agencies to request payment for services rendered. The form is also known as a “Claim for Amounts Due in the Case of Deceased Creditor” and is used primarily when an individual or entity has provided goods or services to a deceased person, and seeks compensation from their estate.

The SF 1157 form requires detailed information, including the name and address of the creditor, as well as information about the deceased debtor’s estate. Information about any assets owned by the deceased individual may be required in order to assess how much money can be recovered from their estate. Once completed, the form must be submitted within one year of the date of death.

Individuals who have questions or concerns about completing a SF 1157 form should seek guidance from legal professionals or financial advisors with experience in estate planning and probate law.

SF 1157 Form Example