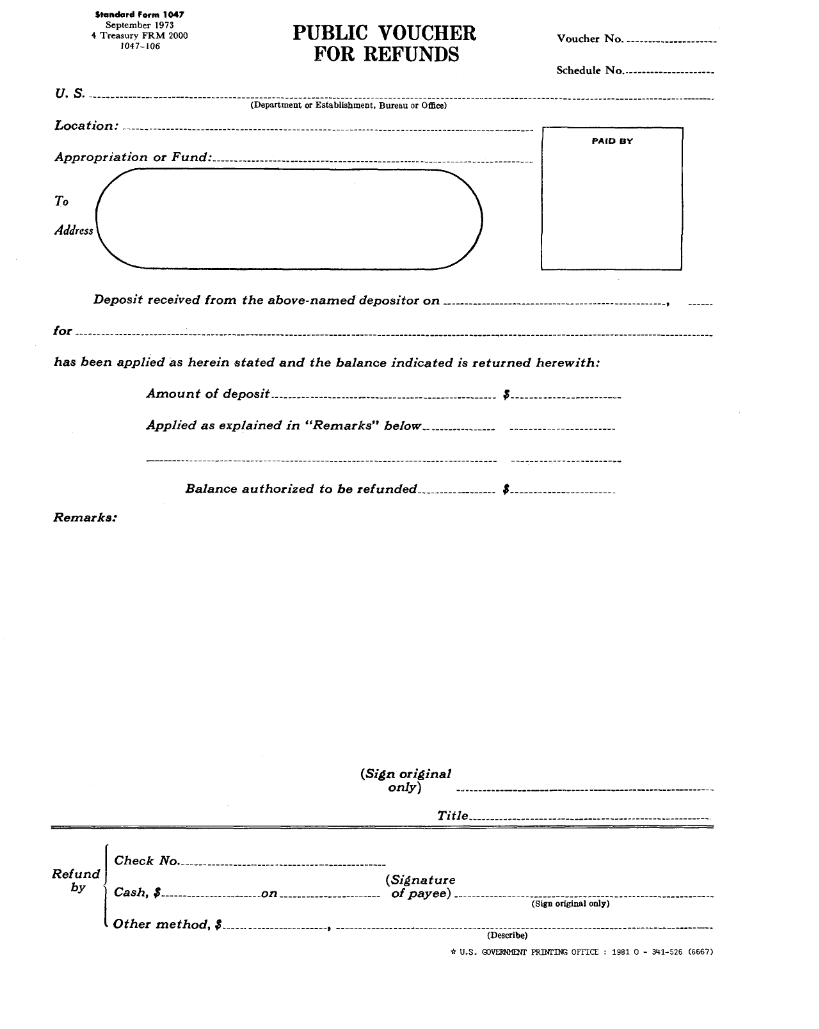

SFFORMS.COM – SF 1047 Form – Public Voucher for Refunds – Letter Format – The SF 1047 form is a crucial document for processing refunds from the government, and it is essential to follow proper procedures when completing it. A letter format can be used to submit the SF 1047 form, providing a clear and concise explanation of the refund request.

Download SF 1047 Form – Public Voucher for Refunds – Letter Format

| Form Number | SF 1047 Form |

| Form Title | Public Voucher for Refunds – Letter Format |

| File Size | 64 KB |

| Date | 09/1973 |

What is a SF 1047 Form?

The SF 1047 Form is a document used by federal agencies in the United States for requesting refunds of payments. This form serves as a public voucher that contains information on the agency making the payment, the payee or recipient, and the amount paid. The form also includes space for details on why a refund is being requested.

The SF 1047 Form is typically used when an overpayment has been made to a vendor or contractor, or when an erroneous payment has been processed. It can also be used to request refunds for travel expenses that were not incurred or other types of reimbursements that are no longer needed.

When submitting an SF 1047 Form, it’s essential to include all relevant documentation to support the request for a refund. Failure to provide adequate documentation may result in delays or denials of the refund request. It’s important to note that this form must be submitted within three years from the date of payment unless otherwise specified by law.

What is the Purpose of SF 1047 Form?

The SF 1047 Form is a public voucher for refunds used by the federal government to issue payment refunds or reimbursements. This form is typically used to refund amounts paid by mistake or overpayment, and it may also be used to cover expenses incurred by individuals on behalf of the government.

In terms of format, the SF 1047 Form is usually presented as a letter addressed to the agency responsible for issuing the payment. The letter must include specific details such as name, address, social security number or taxpayer identification number, and a brief description of why the refund is being requested.

Overall, the purpose of SF 1047 Form is an important part of ensuring that federal payments are properly allocated and mistakes are corrected in a timely manner. By using this form correctly and accurately reporting any errors or overpayments made by either party involved in financial transactions with the government ensures that funds are effectively managed and accounted for.

Where Can I Find a SF 1047 Form?

If you are looking for an SF 1047 form, there are several ways to obtain it. The easiest way is to visit the official website of the United States Government Printing Office. You can download the PDF version of the SF 1047 form from their website and print it out for your use.

Alternatively, you can also visit any local government office or military base where they have a supply of these forms available. They may provide you with a physical copy of the form free of charge.

When filling out an SF 1047 form, be sure to follow all instructions carefully and accurately to avoid any errors or delays in processing your refund request. Additionally, if you have any questions about completing this form or need further information on how to obtain refunds, contact your respective government agency for assistance.

SF 1047 Form – Public Voucher for Refunds – Letter Format

The SF 1047 Form, also known as the Public Voucher for Refunds, is a document used by federal agencies to request refunds from vendors or contractors. The form serves as a request for the refund of overpayments, erroneous payments, and duplicate payments made to a vendor or contractor.

When submitting an SF 1047 Form, it is important to follow the proper letter format in order to ensure that all necessary information is included and that the refund process runs smoothly. This typically involves including a header with the name and address of both the agency and vendor/contractor, followed by a brief introduction explaining the reason for the refund request.

Next, the body of the letter should provide specific details related to the payment(s) in question, such as dates and amounts. The letter should then clearly state that a refund is being requested and include instructions on how to remit payment back to the agency. Finally, it is important to sign and date the letter before sending it off for processing.

SF 1047 Form Example