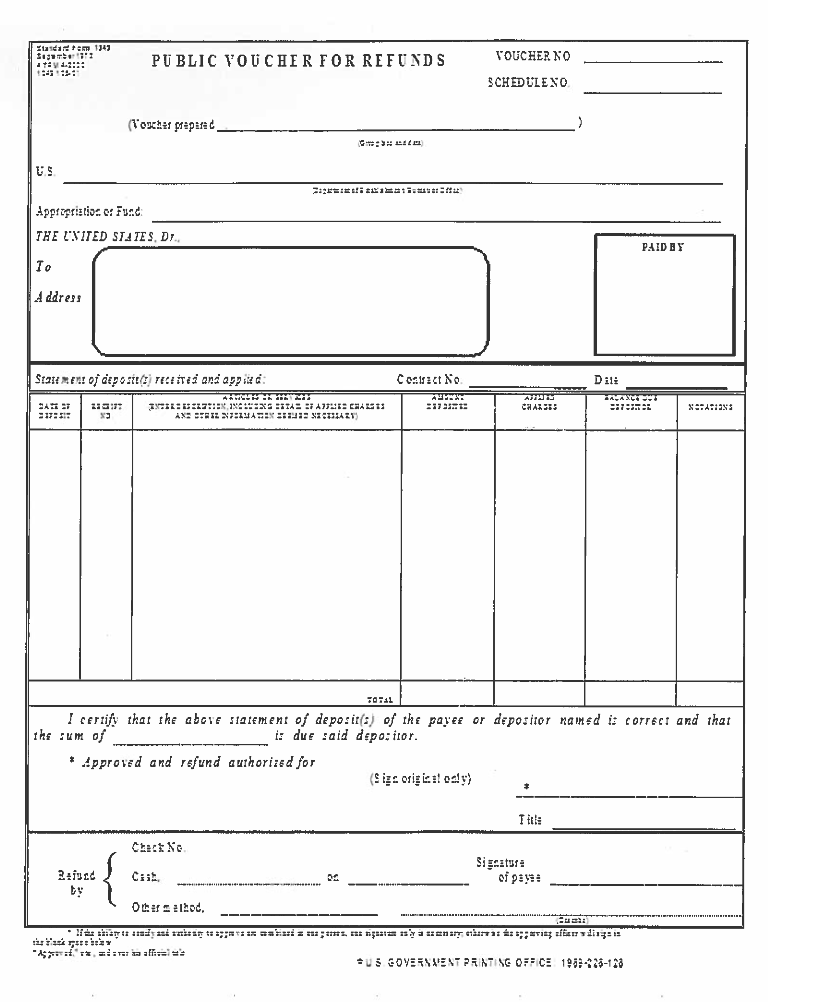

SFFORMS.COM – SF 1049 Form – Public Voucher for Refunds – Table Format – If you’re a federal employee who has incurred expenses on behalf of the government, you may be able to receive a refund for those costs. The SF 1049 form, also known as the Public Voucher for Refunds, is used to request reimbursement for these expenses. This form is typically used by employees who have paid out-of-pocket for travel, training, or supplies that are essential to their job duties.

Download SF 1049 Form – Public Voucher for Refunds – Table Format

| Form Number | SF 1049 Form |

| Form Title | Public Voucher for Refunds – Table Format |

| File Size | 792 KB |

| Date | 09/1973 |

What is a SF 1049 Form?

The SF 1049 form is a public voucher for refunds that is presented in table format. This form is used by federal agencies, civilian employees, and military personnel to request reimbursement or refund for expenses incurred while on official duty. The purpose of this form is to simplify the process of requesting refunds or reimbursements by providing a clear and concise table format.

The SF 1049 form requires details such as the name of the payee, address, social security number or tax ID number, amount of refund requested, and a brief description of the reason for the refund. The form should also include any supporting documentation such as receipts or invoices.

Once completed and submitted, the SF 1049 form will be reviewed by an authorized agency representative who will determine if the request meets all required criteria. If approved, funds will be refunded in accordance with agency regulations and procedures. Overall, this form serves as an efficient tool for individuals seeking reimbursement for authorized expenses while on official duty.

What is the Purpose of SF 1049 Form?

The SF 1049 Form is used to request a refund or reimbursement from the federal government. This form is specifically designed for public entities, such as state and local governments, that have received federal funds for various projects and programs.

The purpose of this form is to provide a standardized format for requesting refunds or reimbursements, ensuring that all necessary information is included and reducing the risk of errors or delays in processing. The table format allows for clear organization of expenses and supporting documentation, making it easier for both the requester and the approving authority to review and verify all charges.

Overall, the SF 1049 Form serves as an important tool for maintaining transparency and accountability in the use of federal funds by public entities. By providing detailed documentation of expenses and following established procedures for requesting refunds or reimbursements, these organizations can ensure that they are using taxpayer dollars responsibly and efficiently.

Where Can I Find a SF 1049 Form?

If you’re looking to get your hands on an SF 1049 form, there are a few places where you can find it. One option is to visit the official website of the General Services Administration (GSA). The GSA provides a comprehensive collection of government forms that are available for download, and the SF 1049 form is one of them.

Another option is to check with your organization’s accounting or finance department as they may have copies available. They can also provide guidance on how to fill out and submit the form correctly.

Lastly, you can visit your nearest Federal agency office or post office. These offices usually keep copies of commonly used federal forms such as the SF 1049 form.

In summary, obtaining an SF 1049 form should be a relatively easy task as long as you know where to look. Whether it’s through online sources or physical offices, make sure that you have all necessary information and documentation before filling out and submitting the form.

SF 1049 Form – Public Voucher for Refunds – Table Format

The SF 1049 Form is a Public Voucher for Refunds used by federal agencies to process refunds of money previously paid to the government. It consists of two parts: Part 1, which is completed by the person requesting the refund and includes information such as the reason for the refund and the amount requested, and Part 2, which is completed by the agency that processed the original payment.

One way to present this information in a clear and organized manner is through a table format. The table can include columns for important details such as the voucher number, date submitted, amount requested, reason for refund, and status of request. This allows both parties involved to easily track and reference important information related to the refund request.

In addition to providing clarity and organization, using a table format can also help reduce errors or misunderstandings regarding refund requests. By having all necessary information clearly presented in one place, it becomes easier to identify discrepancies or missing details that may delay or complicate the processing of refunds.

SF 1049 Form Example