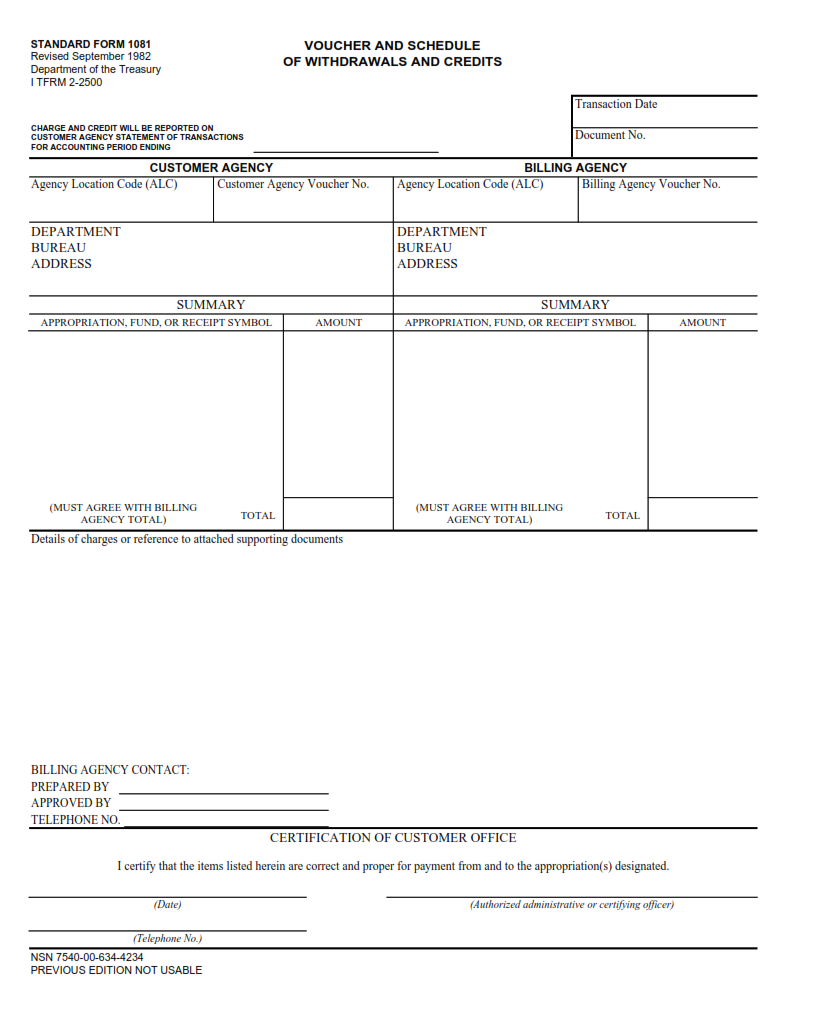

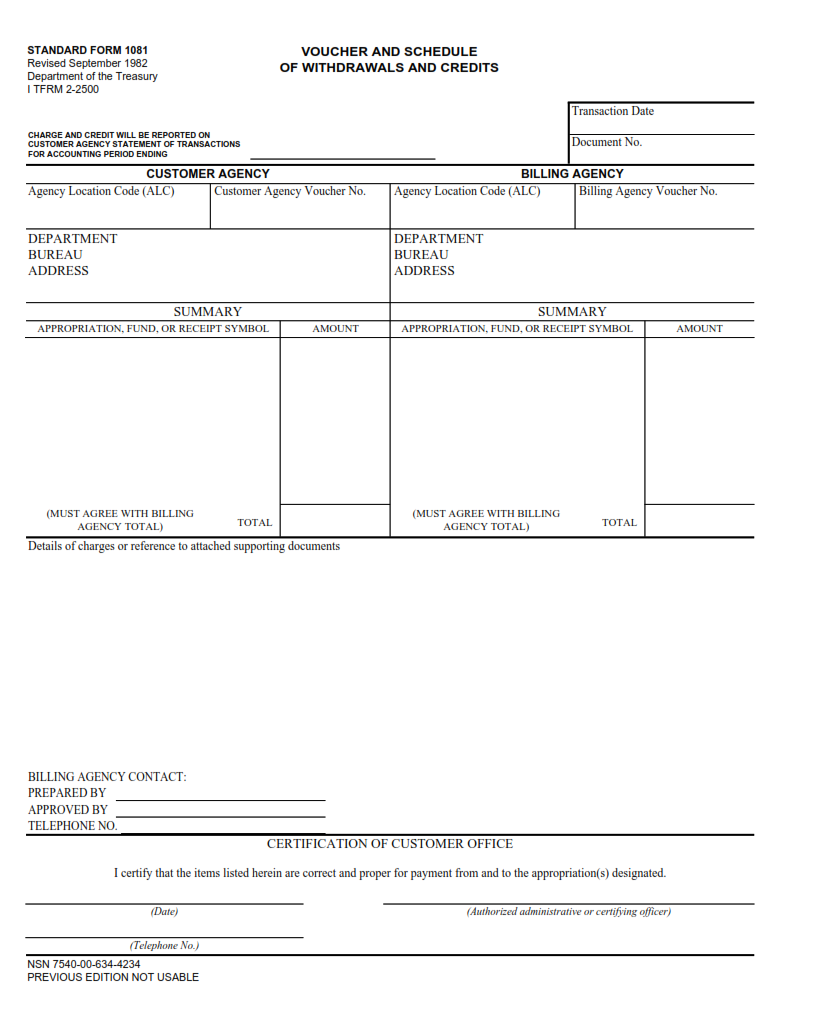

SFFORMS.COM – SF 1081 Form – Voucher and Schedule of Withdrawals and Credits – The SF 1081 Form is a vital document that government agencies use to keep track of their financial transactions. It serves as both a Voucher and Schedule of Withdrawals and Credits, providing a detailed breakdown of all expenses and revenue. The form is commonly used for reimbursing employees, tracking travel expenses, and processing payments to vendors.

Download SF 1081 Form – Voucher and Schedule of Withdrawals and Credits

| Form Number | SF 1081 Form |

| Form Title | Voucher and Schedule of Withdrawals and Credits |

| File Size | 614 KB |

| Date | 09/1982 |

What is a SF 1081 Form?

The SF 1081 Form is a Voucher and Schedule of Withdrawals and Credits that is used by federal agencies to process payments. Essentially, this form serves as a record of any transactions that involve the withdrawal or deposit of funds from a government account. The information provided on this form includes the date, amount, and purpose of each transaction.

One of the key benefits of using the SF 1081 Form is that it helps ensure accountability and transparency in financial management. By tracking all withdrawals and credits, government agencies can easily identify any discrepancies or potential issues with their accounts. This can help prevent fraud, waste, and abuse within the federal government.

Overall, the SF 1081 Form plays an important role in financial management for federal agencies. Whether you’re a government employee who needs to process payments or an external stakeholder who wants to stay informed about how taxpayer dollars are being spent, understanding this form is essential for ensuring transparency and accountability in public financing.

What is the Purpose of SF 1081 Form?

The SF 1081 form plays an important role in the financial record keeping of government agencies. It is a voucher and schedule of withdrawals and credits that documents how funds have been disbursed or credited to an agency’s account. The purpose of this form is to ensure that all financial transactions are accounted for and properly recorded, which helps prevent fraud, waste, and abuse.

In addition to providing a detailed record of financial transactions, the SF 1081 form also serves as a means of controlling spending. By requiring agencies to document each withdrawal or credit made from their accounts, it helps ensure that funds are being used appropriately and in accordance with established rules and regulations. This can be particularly important for agencies that receive large amounts of federal funding, as they need to demonstrate accountability and transparency in how they use those funds.

Overall, the SF 1081 form is an essential tool for ensuring good financial management practices within government agencies. By providing a comprehensive record of all financial transactions and helping to control spending, it helps promote accountability and transparency while also preventing fraud and other types of financial misconduct.

Where Can I Find a SF 1081 Form?

The SF 1081 Form is a voucher and schedule of withdrawals and credits that is used by federal agencies to document their financial transactions. This form is important because it helps ensure that all expenditures are properly authorized, recorded, and monitored. If you need to find a SF 1081 Form, there are several places where you can look.

One option is to search online for the form using your favorite search engine. You may be able to find the form on the website of the agency that you work for or do business with. Another option is to check with your agency’s finance or accounting department to see if they have copies of the form available. They may be able to provide you with a digital copy or direct you to where you can obtain one.

Finally, if all else fails, you can try contacting the General Services Administration (GSA) which oversees many of the forms used by federal agencies. They may be able to assist you in obtaining a copy of the SF 1081 Form or directing you towards someone who has it readily available for download or printout.

SF 1081 Form – Voucher and Schedule of Withdrawals and Credits

The SF 1081 form, also known as the Voucher and Schedule of Withdrawals and Credits, is a document used by federal agencies to record financial transactions. The form contains information on the amount of money withdrawn or credited from an account, the purpose of the transaction, and any supporting documentation.

One of the key uses of the SF 1081 form is to track government funds. Each time a withdrawal or credit is made from a government account, it must be recorded on this form. This helps ensure that all financial transactions are properly accounted for and can be easily audited if necessary.

In addition to tracking financial transactions, the SF 1081 form also serves as a communication tool between different departments within an agency. For example, if one department needs to transfer funds to another department for a specific project or expense, they can use this form to initiate that transfer and provide all necessary documentation for approval. Overall, the SF 1081 form plays an important role in ensuring transparency and accountability in government finances.

SF 1081 Form Example