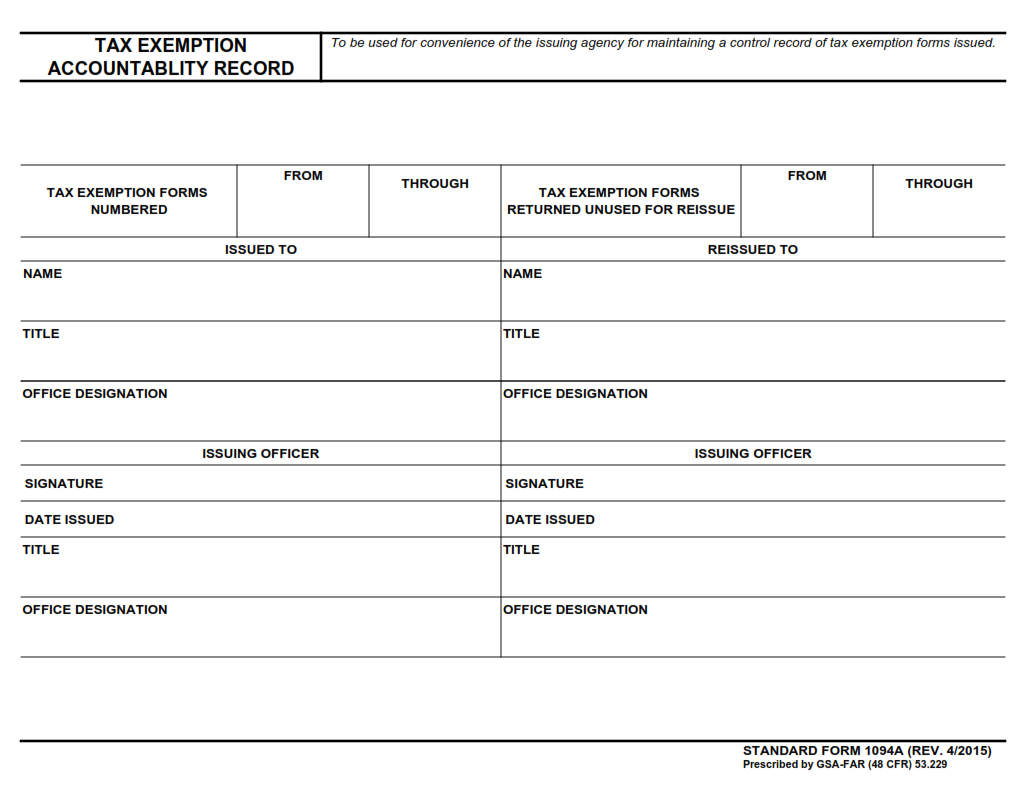

SFFORMS.COM – SF 1094A Form – Tax Exemption Accountability Record – The SF 1094A form is a critical document that every organization seeking tax exemption must fill out. This form, also known as the Tax Exemption Accountability Record, outlines the details of an organization’s income and expenses, including contributions and distributions. The IRS requires organizations to provide this information to ensure that they are operating within their tax-exempt status require

Download SF 1094A Form – Tax Exemption Accountability Record

| Form Number | SF 1094A Form |

| Form Title | Tax Exemption Accountability Record |

| File Size | 1 MB |

| Date | 04/2015 |

What is a SF 1094A Form?

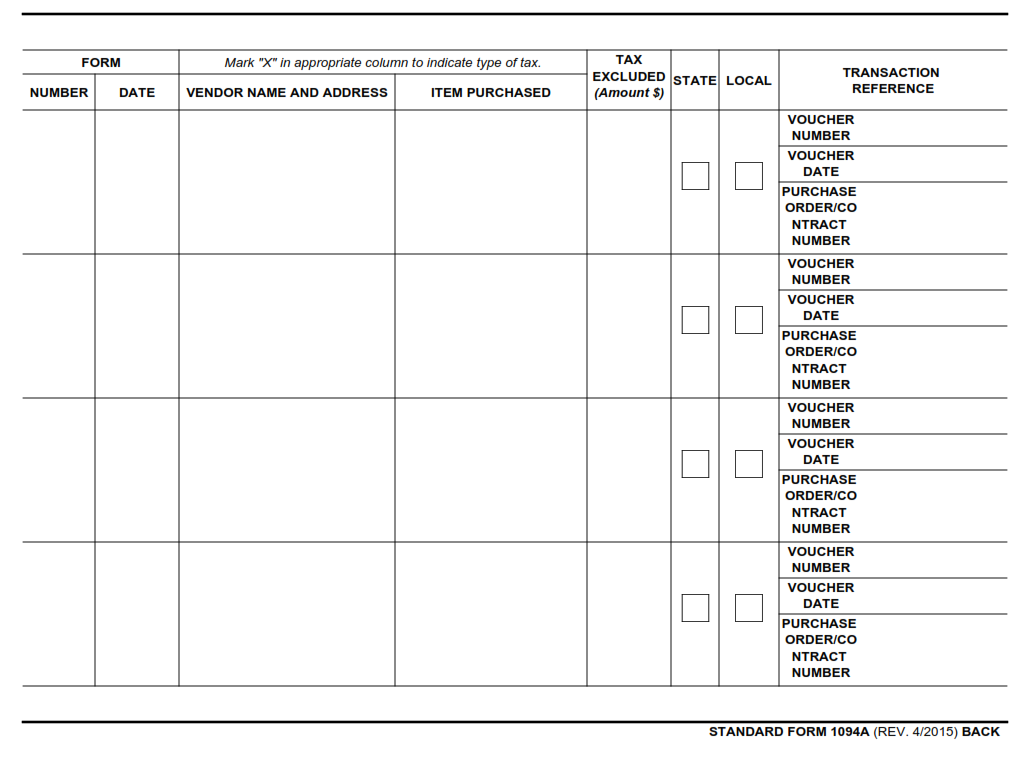

The SF 1094A Form is a tax exemption accountability record that is used by government agencies to track and report tax-exempt purchases. This form is part of the Federal Acquisition Regulations (FAR) and must be filled out every time an agency makes a purchase using a tax exemption.

This form requires detailed information about the purchase, including the name of the vendor, the date of purchase, and the amount paid. It also requires information about why the purchase was tax-exempt, such as a specific exemption code or certificate number.

By keeping accurate records on this form, government agencies can ensure that they are complying with all tax laws and regulations. It also helps to prevent fraud or abuse of tax-exempt status by ensuring that only eligible purchases are made without paying taxes. The SF 1094A Form is an important tool for maintaining transparency in government spending and ensuring that taxpayer dollars are being used responsibly.

What is the Purpose of SF 1094A Form?

The SF 1094A Form is an important document that is used by organizations that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code. The purpose of this form is to provide a record of all tax-exempt purchases made by the organization throughout the year. The form must be completed and filed with the appropriate government agency on an annual basis.

The SF 1094A Form helps to ensure that tax-exempt organizations are using their funds in accordance with their tax-exempt status. It provides accountability for all purchases made using tax-exempt funds, which helps to prevent fraud and misuse of funds. Additionally, it helps to demonstrate compliance with IRS regulations and requirements.

Overall, the SF 1094A Form plays a crucial role in ensuring that tax-exempt organizations are using their resources in a responsible manner. By providing transparency and accountability for all purchases made using tax-exempt funds, this form helps to maintain public trust and confidence in these organizations.

Where Can I Find a SF 1094A Form?

The SF 1094A Form is used to maintain records of tax exempt properties owned by non-profit organizations. It is an essential document that must be submitted on a regular basis to the government for accountability purposes. Non-profits are required to provide this form in order to prove their eligibility for tax exemption status.

There are several places where you can find a SF 1094A Form. The most common location is the official website of the Internal Revenue Service (IRS). They offer a range of downloadable forms, including this one. You could also visit your local IRS office and request a copy in person.

Another option is to check with your state’s Department of Revenue or Department of Taxation. In some cases, they may require additional documents or information before providing you with the form, so it is best to contact them beforehand. Finally, many online legal services offer access to various IRS forms, including the SF 1094A Form, for a fee.

SF 1094A Form – Tax Exemption Accountability Record

The SF 1094A Form is a tax exemption accountability record that must be completed by nonprofit organizations and other entities that are seeking tax exemptions. The form is used to document the organization’s compliance with federal tax laws and regulations, including those related to charitable contributions and fundraising activities.

One of the key requirements of the SF 1094A Form is that it must be submitted annually to the Internal Revenue Service (IRS). Failure to file this form can result in penalties and other legal consequences for the organization, so it is important to ensure that all necessary information is included.

In addition to documenting compliance with federal tax laws, the SF 1094A Form can also help organizations track their own fundraising activities and ensure that they are meeting their financial goals. By keeping detailed records of donations received, expenses incurred, and other relevant data, nonprofits can make informed decisions about how best to use their resources in support of their mission.

SF 1094A Form Example