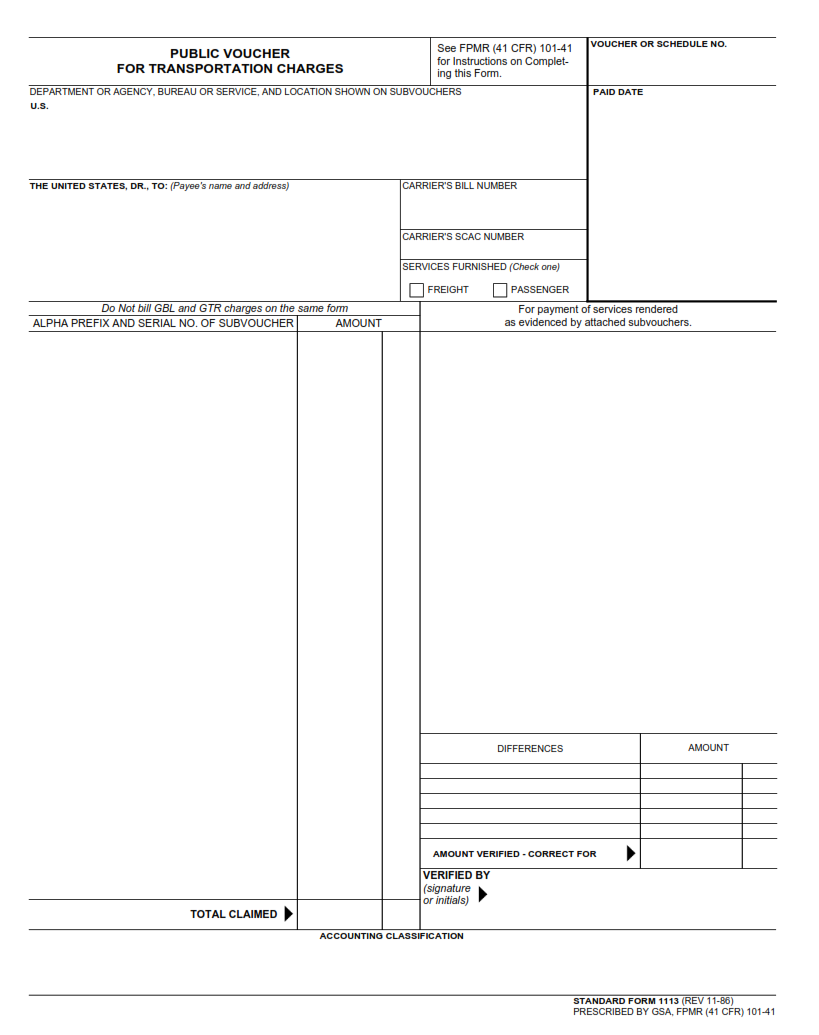

SFFORMS.COM – SF 1113 Form – Public Voucher for Transportation Charges – The SF 1113 Form is a crucial document for individuals or organizations that require transportation services and need to submit vouchers for reimbursement. This form, also known as the Public Voucher for Transportation Charges, is used by federal agencies to process payments for transportation services rendered by commercial carriers.

Download SF 1113 Form – Public Voucher for Transportation Charges

| Form Number | SF 1113 Form |

| Form Title | Public Voucher for Transportation Charges |

| File Size | 469 KB |

| Date | 11/1986 |

What is a SF 1113 Form?

The SF 1113 Form is a Public Voucher for Transportation Charges that is used by the United States government to request payment for transportation services rendered. This form is required when submitting payment requests for travel expenses related to official business, including both civilian and military travel.

The form contains information on the traveler’s name, organization, and purpose of travel. It also includes details such as the mode of transportation used, dates of travel, destination and origin points, and cost breakdowns of each expense incurred during the trip. The SF 1113 Form must be completed accurately in order to avoid delays or rejections in payment processing.

In addition to the basic information required on the form itself, supporting documentation such as receipts or invoices may also need to be submitted along with it. Failure to provide adequate documentation can result in delayed payments or even penalties if fraud is suspected. Overall, adherence to proper procedures when filling out an SF 1113 Form is crucial in ensuring prompt and accurate reimbursement for government-related travel expenses.

What is the Purpose of SF 1113 Form?

The SF 1113 form is a document that serves as a public voucher for transportation charges incurred by federal employees on official travel. The purpose of this form is to provide a detailed record of all expenses related to transportation, including airfare, rental cars, and other forms of transportation.

The SF 1113 form is an essential tool for ensuring that government funds are used responsibly and in accordance with federal regulations. When completed correctly, it provides an accurate accounting of all transportation-related expenses associated with official travel.

Ultimately, the goal of the SF 1113 form is to ensure that government agencies are able to accurately track and manage their transportation budgets while also ensuring that employees are reimbursed appropriately for any expenses related to their official duties. As such, it plays an important role in promoting transparency and accountability within the federal government.

Where Can I Find a SF 1113 Form?

If you’re looking for an SF 1113 form, the first place to check is the official website of the U.S. government’s General Services Administration (GSA). This site offers a variety of forms that are commonly used in government transactions, including the SF 1113. You can download and print this form directly from the GSA website.

Another option for finding an SF 1113 form is to contact your local transportation office or agency. They may have copies of this form available for pickup or may be able to provide you with information on how to obtain one. Additionally, if you work for a government agency that requires the use of an SF 1113, your internal administrative office should be able to provide you with a copy of this document.

Overall, while it may take some effort to locate an SF 1113 form, there are several options available for obtaining one. Whether you choose to download it from the GSA website or reach out to a local transportation office, having this document on hand can help ensure that your transportation charges are accurately recorded and processed in accordance with applicable regulations.

SF 1113 Form – Public Voucher for Transportation Charges

The SF 1113 Form, also known as Public Voucher for Transportation Charges, is a document used by the United States government to reimburse individuals or companies for transportation expenses incurred while conducting official business. This form is typically used for travel expenses such as airfare, rental cars, and public transportation.

The SF 1113 Form must be completed accurately and include all necessary receipts and documentation to support the claimed expenses. The individual or company submitting the form must also provide their taxpayer identification number (TIN) or social security number (SSN) for tax purposes.

Once submitted, the form will be reviewed by government officials to ensure compliance with regulations. If approved, payment will be issued within a reasonable timeframe based on government processes.

Overall, the SF 1113 Form serves as an important tool in ensuring that individuals and companies are reimbursed appropriately for transportation expenses incurred while conducting official government business.

SF 1113 Form Example