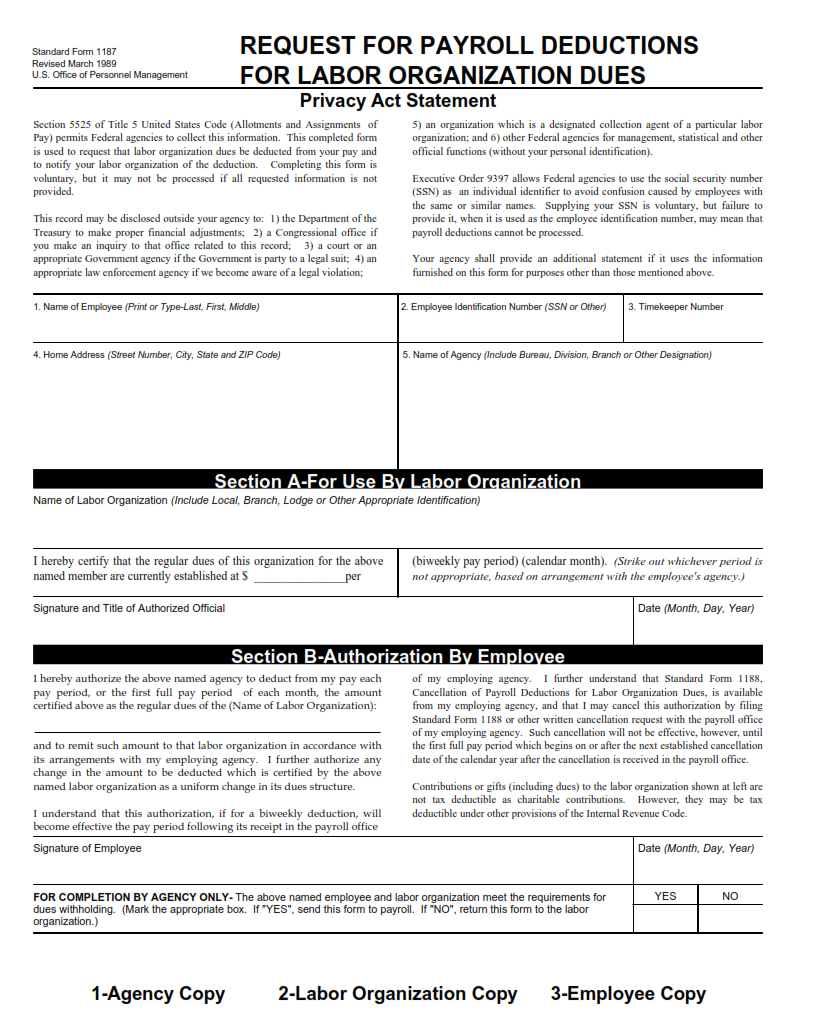

SFFORMS.COM – SF 1187 Form – Request for Payroll Deductions for Labor Organization Dues – The SF 1187 Form is a crucial document for those individuals who are part of a labor union. This form is used to request payroll deductions for labor organization dues from their employer. The form ensures that the dues are deducted automatically from the employee’s salary and forwarded to the union.

Download SF 1187 Form – Request for Payroll Deductions for Labor Organization Dues

| Form Number | SF 1187 Form |

| Form Title | Request for Payroll Deductions for Labor Organization Dues |

| File Size | 39 KB |

| Date | 03/1989 |

What is a SF 1187 Form?

The SF 1187 Form is a document used by employees to authorize their employer to deduct labor organization dues from their paychecks. It is an important form for unionized employees who wish to have their membership fees automatically deducted from their paychecks, as it ensures that they remain in good standing with the union. The form must be completed and signed by the employee, and then submitted to the employer for processing.

One of the key benefits of using the SF 1187 Form is that it simplifies the process of paying labor organization dues. Rather than having to remember to make a payment each month or quarter, employees can set up automatic deductions and ensure that their dues are always paid on time. This also helps unions maintain consistent revenue streams, which in turn allows them to better serve their members.

While completing an SF 1187 Form may seem like a small task, it is an important step toward ensuring continued support for labor organizations. By authorizing payroll deductions for union dues, workers can help support collective bargaining efforts and advocacy work aimed at improving working conditions across various industries.

What is the Purpose of SF 1187 Form?

The SF 1187 form is used to request payroll deductions for labor organization dues. The purpose of this form is to provide a convenient and efficient way for federal employees to pay their union dues through automatic payroll deductions. By completing the SF 1187 form, employees authorize their agency’s payroll office to deduct a specific amount from each paycheck and forward it directly to their designated labor organization.

One of the benefits of using this form is that it saves time and effort for both the employee and the union. Employees no longer have to remember when their dues are due or manually make payments, while unions can rely on consistent, reliable contributions from their members without having to chase down individual payments. Additionally, by pooling resources through automated payroll deductions, unions can better support their members by providing training programs, legal assistance, lobbying efforts, and other services.

Overall, the SF 1187 form serves an important role in streamlining the process of collecting union dues from federal employees. By simplifying payment methods and ensuring regular contributions from members, unions can more effectively represent and support their workforce.

Where Can I Find a SF 1187 Form?

The SF 1187 Form is a crucial document that allows federal employees to initiate payroll deductions for labor organization dues. This form is required by the government and must be obtained by the employee’s chosen labor union. Employees must fill out this form completely and correctly, ensuring that it includes their personal information, including name, address, and social security number.

There are a few ways for federal employees to obtain an SF 1187 Form. Firstly, they can contact their respective labor unions and request a copy of the form. Secondly, they can visit the Office of Personnel Management (OPM) website where they can find an electronic version of the SF 1187 Form which can be downloaded from their computer or mobile device.

In conclusion, obtaining an SF 1187 Form is essential if you are seeking payroll deductions for labor organization dues as a federal employee. With various options available like requesting one from your union or downloading one online through OPM’s website makes it easy to get hold of this necessary document.

SF 1187 Form – Request for Payroll Deductions for Labor Organization Dues

The SF 1187 Form is a government document that allows federal employees to request payroll deductions for labor organization dues. This form is used by employees who are members of unions, associations, and other labor organizations.

By completing the SF 1187 Form, federal employees can authorize their employer to deduct a specific amount from their paycheck each pay period and send it directly to their designated union or association. This process ensures that membership dues are paid on time and accurately.

Federal employees must fill out the SF 1187 Form when they first join a union or association or when they want to change their payroll deduction amount. It’s essential for employees to keep track of their dues payments and ensure that they’re being deducted correctly through regular monitoring of their pay stubs. Overall, the SF 1187 Form helps streamline the payment process for union and association memberships for federal employees.

SF 1187 Form Example