SFFORMS.COM – SF 1188 Form – Cancellation of Payroll Deductions for Labor Organization Dues – The SF 1188 form is a crucial document for employees who are members of labor organizations. It serves as an official request for the cancellation of payroll deductions for union dues, thereby providing individuals with complete control over their finances. Regardless of the reason behind the decision to cancel these deductions, employees must understand the process and requirements involved in completing this form.

Download SF 1188 Form – Cancellation of Payroll Deductions for Labor Organization Dues

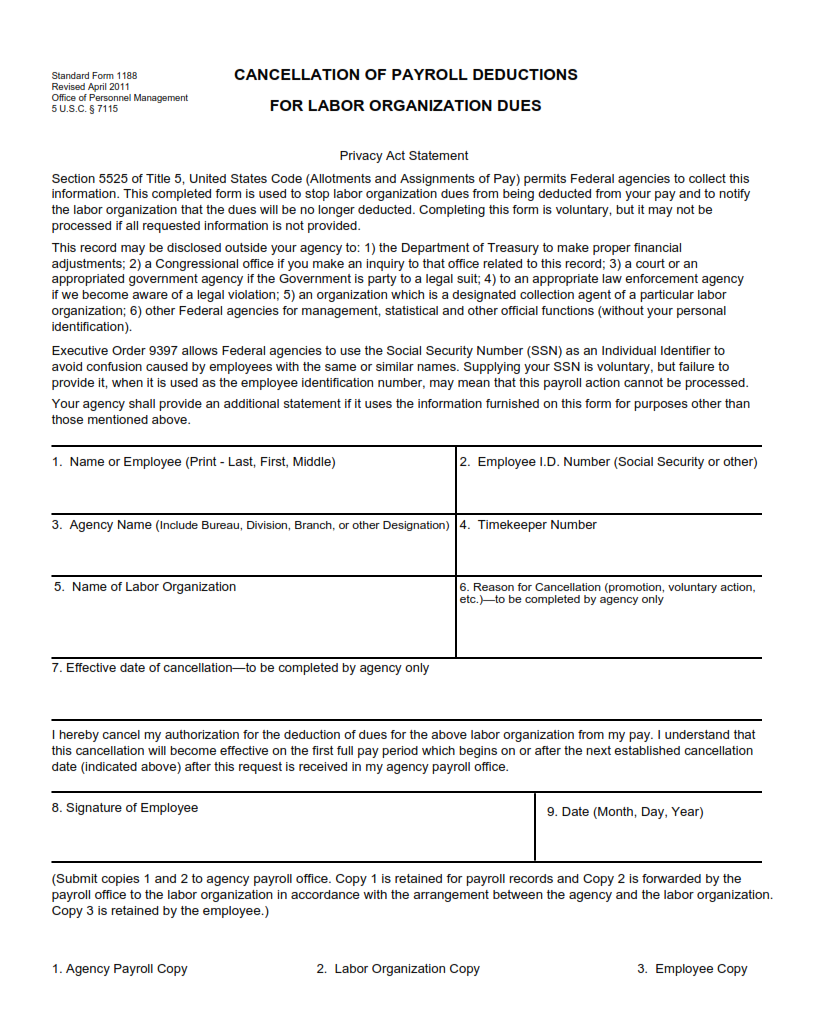

| Form Number | SF 1188 Form |

| Form Title | Cancellation of Payroll Deductions for Labor Organization Dues |

| File Size | 72 KB |

| Date | 04/2011 |

What is a SF 1188 Form?

The SF 1188 Form is an official document used by federal employees to cancel their payroll deductions for labor organization dues. This form is used when the employee no longer wants to be a part of the labor union or any other membership-based organization that requires regular payments from its members.

When filling out the SF 1188 Form, employees must provide certain information such as their name, social security number, and agency or department. They must also indicate whether they want to cancel all or only a portion of their payroll deductions for labor organization dues.

Once submitted, the SF 1188 Form will take effect on the next scheduled pay date after it has been processed by the employee’s agency or department. It is important to note that cancelling payroll deductions for labor organization dues does not necessarily mean that an employee is withdrawing from their union membership altogether.

What is the Purpose of SF 1188 Form?

The SF 1188 Form is an official document that is used by federal employees who wish to cancel their payroll deductions for labor organization dues. This form allows employees to revoke their authorization for the deduction of union dues from their paychecks. Once completed, the SF 1188 Form must be submitted to the employee’s HR department.

The purpose of this form is to give federal employees greater control over how their money is spent. By allowing them to cancel payroll deductions for union dues, they are able to make more informed decisions about whether or not they want to support a particular labor organization. Additionally, it ensures that employees are not forced into paying union dues against their will.

Overall, the SF 1188 Form serves as an important tool for protecting the rights and interests of federal employees. It enables them to have greater autonomy over their finances and ensures that they are free from any undue pressure or coercion when it comes to supporting labor organizations.

Where Can I Find a SF 1188 Form?

The SF 1188 form is an important document for federal employees who wish to cancel their payroll deductions for labor organization dues. This form is used when an employee no longer wants to be a member of a union or other labor organization and wants to stop the automatic deduction of union dues from their paycheck. The form must be completed and submitted to the appropriate payroll office in order for the cancellation to take effect.

To find a SF 1188 form, federal employees can visit their agency’s human resources department or payroll office. These offices should have copies of the form available for employees to fill out and submit. Alternatively, employees may also be able to download a copy of the SF 1188 form from their agency’s website or from the Office of Personnel Management (OPM) website.

It is important for federal employees who want to cancel their payroll deductions for labor organization dues to complete and submit an SF 1188 form as soon as possible in order to avoid continued deductions from their paychecks. Failure to do so could result in continued membership in a union or other labor organization, as well as ongoing deductions from your paycheck even if you are no longer interested in being part of that group.

SF 1188 Form – Cancellation of Payroll Deductions for Labor Organization Dues

The SF 1188 form is used to cancel payroll deductions for labor organization dues. This form is required if an employee wants to stop paying union dues or fees that are automatically deducted from their paychecks. The process of cancelling these deductions can vary depending on the terms of the collective bargaining agreement between the employer and the union.

To complete the SF 1188 form, employees must provide their personal information, including their name, address, and social security number. They must also indicate which labor organization they are a member of and provide details about their membership status. Employers will then receive notification of this cancellation request and must take action to terminate any future payroll deductions for union dues.

It’s important to note that cancelling payroll deductions for labor organization dues does not mean an employee is leaving the union entirely. Employees may still be required to pay certain fees or maintain membership in order to retain certain benefits or rights provided by their collective bargaining agreement. However, completing an SF 1188 form can give employees more control over how their money is being spent and allow them to make informed decisions about their participation in a labor organization.

SF 1188 Form Example