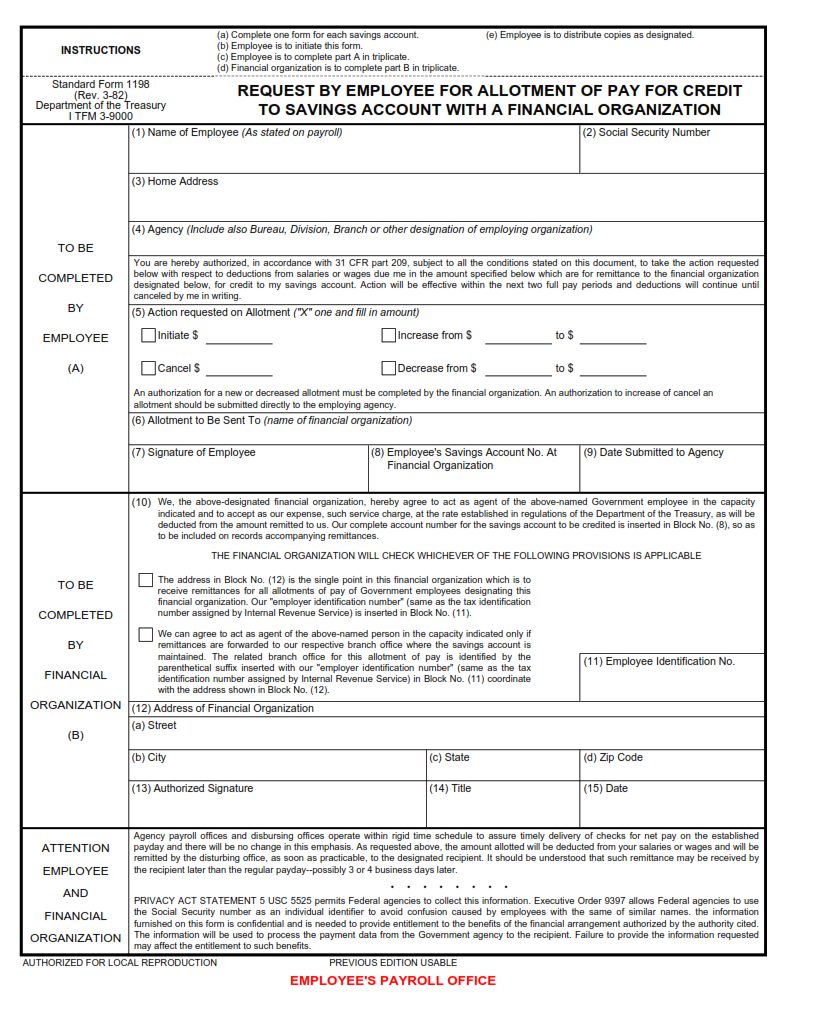

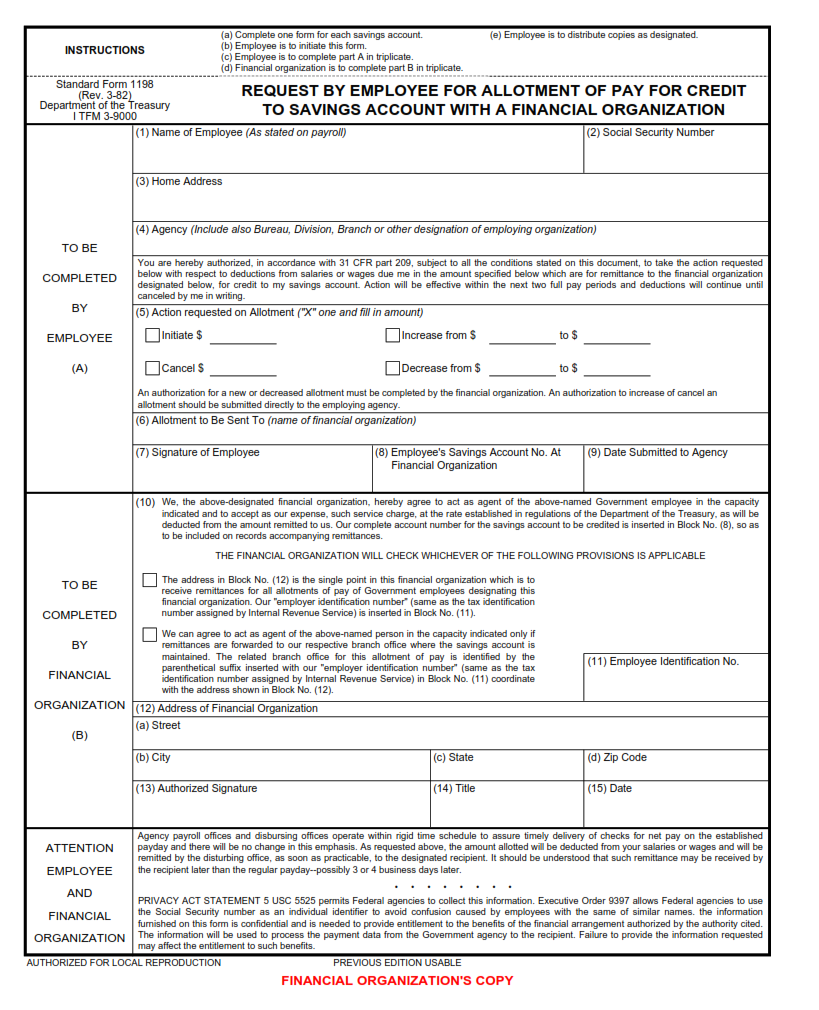

SFFORMS.COM – SF 1198 Form – Request by Employee for Allotment of Pay for Credit to Savings Account with a Financial Organization – The SF 1198 form is an essential document for federal employees who wish to automate the process of saving money from their paychecks. The form, titled “Request by Employee for Allotment of Pay for Credit to Savings Account with a Financial Organization,” enables employees to authorize their employer to transfer a portion of their salary into a savings account with a financial institution.

Download SF 1198 Form – Request by Employee for Allotment of Pay for Credit to Savings Account with a Financial Organization

| Form Number | SF 1198 Form |

| Form Title | Request by Employee for Allotment of Pay for Credit to Savings Account with a Financial Organization |

| File Size | 349 KB |

| Date | 03/1982 |

What is a SF 1198 Form?

The SF 1198 form is a document that federal employees use to request an allotment of their pay for credit to a savings account with a financial organization. The form is often used by government employees who want to set aside a portion of their salary for saving purposes. It’s important to note that the form must be submitted and approved before any deductions can be made from the employee’s paycheck.

The SF 1198 form requires detailed information about the employee, including their name, social security number, and contact information. Additionally, it asks for details about the financial organization where the funds will be deposited, such as its name and address. Employees must also specify how much they want deducted from each paycheck and provide their signature on the form.

Overall, the SF 1198 form is a straightforward document that helps federal employees save money by setting up automatic payroll deductions into their preferred savings account. It offers an easy way for workers to make sure they are saving money consistently without having to take additional steps each pay period.

What is the Purpose of SF 1198 Form?

The SF 1198 form serves as a request by an employee for the allotment of pay for credit to their savings account with a financial organization. This form is typically used within government agencies and serves as a way to authorize the direct deposit of an employee’s pay into a chosen savings account. It’s essential to note that this form only authorizes the allotment of funds from an employee’s pay, and it does not initiate any payments on its own.

One key purpose of the SF 1198 form is to streamline payroll processes by eliminating paper checks. This saves time and resources for both employers and employees. Direct deposit also ensures timely payments and reduces the risk of lost or stolen checks. Additionally, using this form allows employees to easily manage their finances and save money without having to manually transfer funds from their checking accounts.

Overall, the SF 1198 form plays a vital role in simplifying payroll processes while providing employees with greater flexibility in managing their finances. By authorizing direct deposit into savings accounts, this form helps promote financial stability and security for employees while benefiting employers through increased efficiency.

Where Can I Find a SF 1198 Form?

The SF 1198 form can be easily found and downloaded online from the official website of the Office of Personnel Management (OPM). It is specifically designed for employees who wish to request an allotment of their pay to be credited into a savings account with a financial organization. The form requires basic information such as the employee’s name, social security number, and address along with details regarding the financial organization receiving the allotment.

In addition to being available on the OPM website, some government agencies may also provide access to the SF 1198 form through their internal websites or human resources departments. It is important for employees to ensure they are using the most up-to-date version of the form when submitting it to their employer. While completing this form may seem like a small task, it can have significant benefits for those looking to save money and manage their finances more efficiently.

SF 1198 Form – Request by Employee for Allotment of Pay for Credit to Savings Account with a Financial Organization

The SF 1198 form is a request made by employees to allot a portion of their pay for credit into their savings account with a financial organization. This form is commonly used by federal government employees to set up electronic fund transfers (EFT) from their payroll accounts to their savings accounts. It allows employees to easily save money and build up a healthy financial cushion.

One key benefit of using the SF 1198 form is that it helps individuals save automatically without having to manually transfer funds each month. By automating these transactions, individuals are more likely to consistently contribute towards their savings goals. Additionally, this form provides flexibility as employees can choose the amount they want to allocate towards their savings account, making it easy for them to adjust contributions if necessary.

Overall, the SF 1198 form is an excellent tool that helps federal government employees save more efficiently and effectively. By taking advantage of this service, individuals can achieve long-term financial security and stability while also meeting short-term needs and obligations.

SF 1198 Form Example