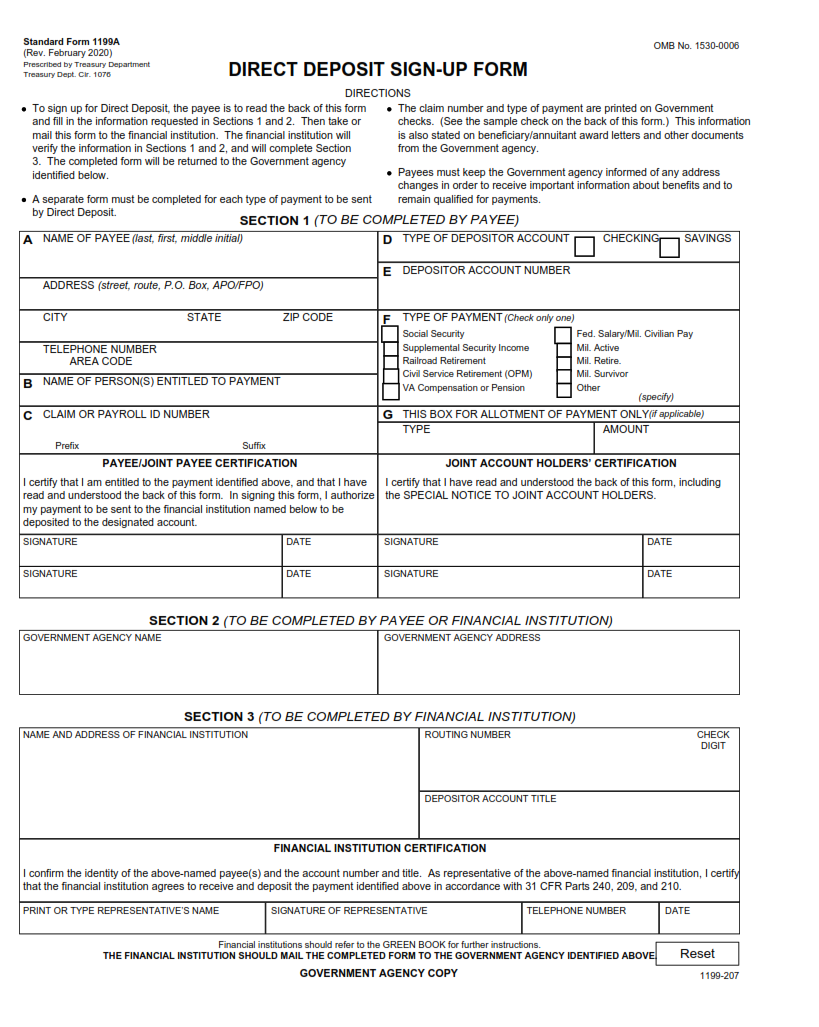

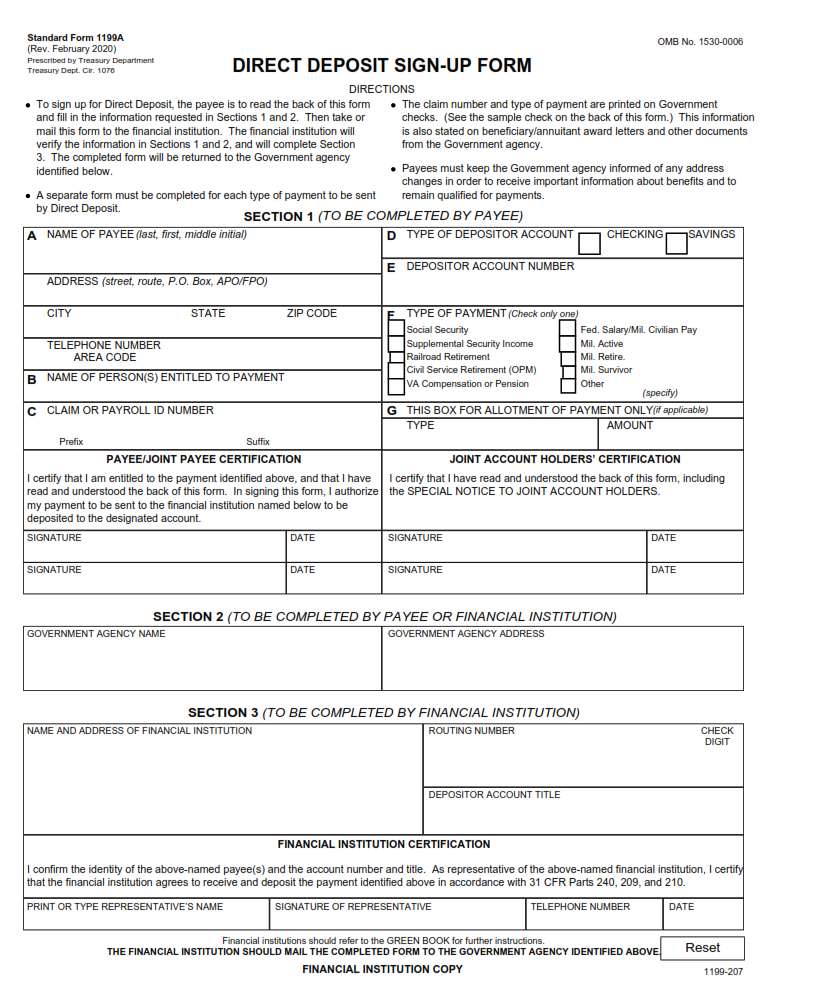

SFFORMS.COM – SF 1199A Form – Direct Deposit Sign-Up Form – The SF 1199A Form, also known as the Direct Deposit Sign-Up Form, is an essential document for federal employees who want to receive their paychecks via direct deposit. This form enables federal employees to authorize the U.S. Treasury Department to deposit their salary directly into their bank accounts, eliminating the need for paper checks.

Download SF 1199A Form – Direct Deposit Sign-Up Form

| Form Number | SF 1199A Form |

| Form Title | Direct Deposit Sign-Up Form |

| File Size | 780 KB |

| Date | 02/2020 |

What is an SF 1199A Form?

The SF 1199A Form is a document used by the US government for direct deposit purposes. This form allows federal employees to authorize their financial institution to receive electronic funds transfer (EFT) payments from the government. The form is also commonly used by retired military personnel, Social Security recipients, and other individuals who receive government benefits.

The SF 1199A Form requires information such as the individual’s name, address, bank account number and routing number. Once completed and signed by the account holder, the form is submitted to the appropriate agency or organization handling their payments. This streamlines payment processing and ensures that funds are deposited directly into the recipient’s bank account on time.

It’s important to note that while completing an SF 1199A Form is optional for most federal employees, some agencies require its submission as part of their payroll process. Additionally, it’s crucial that individuals ensure they have accurately filled out all required sections before submitting their forms to avoid any potential delays or complications in receiving their payments via direct deposit.

What is the Purpose of the SF 1199A Form?

The SF 1199A form is a Direct Deposit Sign-Up Form that is used to establish or change the method by which an individual’s federal salary, retirement, or annuity payments are made. The purpose of this form is to authorize the transfer of funds from a financial institution directly to the individual’s account, eliminating the need for paper checks and reducing the risk of lost or stolen payments.

In addition to its use for federal salary and benefit payments, the SF 1199A form can also be used for other government program payments such as Social Security and Veterans Affairs benefits. By using direct deposit through this form, individuals can enjoy more efficient access to their funds and avoid any potential delays caused by mail delivery or processing time.

Overall, the primary purpose of the SF 1199A form is to provide a secure and reliable way for individuals to receive their federal benefit payments on time and with minimal hassle. As such, it has become an important tool in promoting financial stability among those who rely on these benefits for their livelihoods.

Where Can I Find an SF 1199A Form?

If you’re a federal employee and want to sign up for direct deposit, you’ll need to fill out an SF 1199A form. These forms can be found online at various government websites, including the Office of Personnel Management (OPM) and the Department of Treasury. You can also request a copy from your HR department or payroll office.

Before filling out the SF 1199A form, make sure you have your banking information ready. This includes your bank’s routing number and your account number. You’ll also need to provide personal information such as your name, address, and social security number.

Once you’ve filled out the form completely, submit it to your HR department or payroll office. It may take a few weeks for direct deposit to become active on your account, so be sure to follow up with them if you don’t see any changes after that time period has passed.

SF 1199A Form – Direct Deposit Sign-Up Form

The SF 1199A form is a direct deposit sign-up form used by federal government employees to receive their salary and other payments electronically. This simple form requires basic information such as the employee’s name, Social Security number, and bank account details. Once completed, the employee submits the form to their agency’s payroll office for processing.

There are several benefits of using direct deposit over traditional paper checks. Direct deposit ensures that payments are received on time without delays due to mail delivery or lost checks. It also provides added security as electronic transactions cannot be easily misplaced or stolen like paper checks. Additionally, direct deposit saves time and reduces administrative costs for both employers and employees.

It is important to note that employees should review their bank statements regularly to ensure correct deposits have been made. If there are any discrepancies, they should immediately contact their payroll office for resolution. Overall, the SF 1199A form is a convenient and secure way for federal government employees to receive their pay and other payments through direct deposit.

SF 1199A Form Example