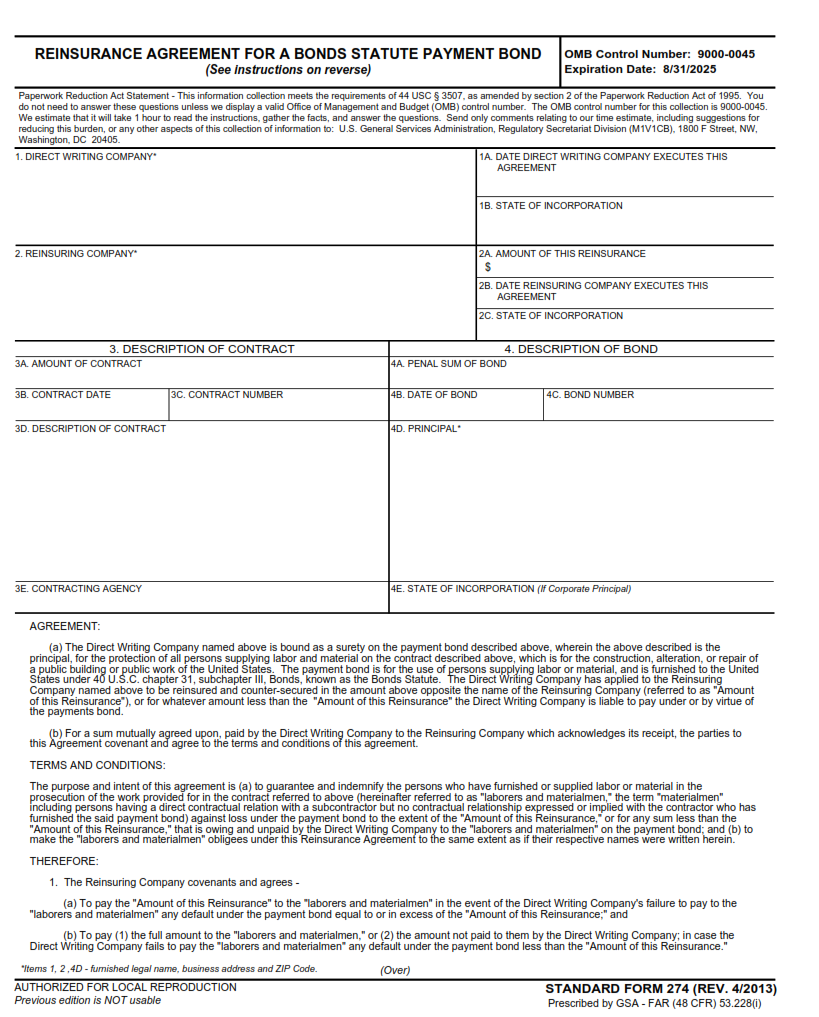

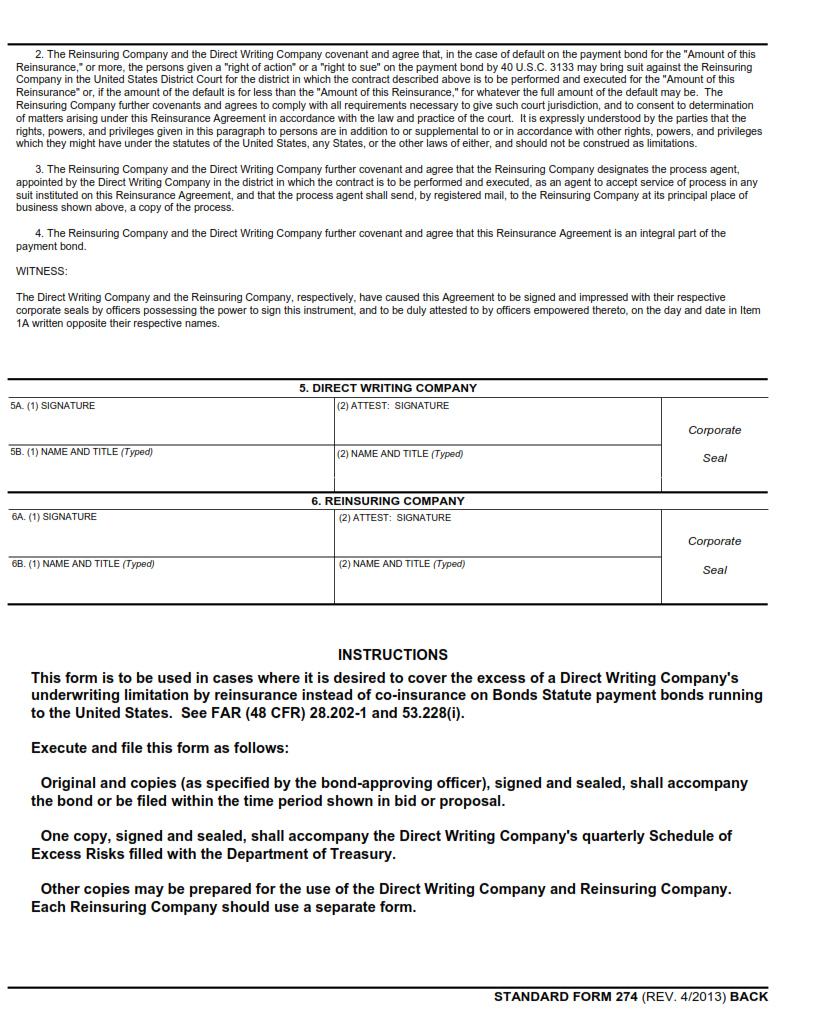

SFFORMS.COM – SF 274 Form – Reinsurance Agreement for a Bonds Statute Payment Bond – An insurance company may provide reinsurance protection for a bonds statute payment bond. This type of agreement insures the bond issuer against any financial losses that may occur if the bond is not paid on time. Reinsurance agreements can be complex, and require both the issuing company and the insurance company to have a clear understanding of their respective obligations.

Download SF 274 Form – Reinsurance Agreement for a Bonds Statute Payment Bond

| Form Number | SF 274 Form |

| Form Title | Reinsurance Agreement for a Bonds Statute Payment Bond |

| File Size | 1 MB |

| Date | 04/2013 |

What is an SF 274 Form?

The SF 274 form is a document that outlines the reinsurance agreement for a Bonds Statute Payment Bond. This bond is required by federal law for construction projects that receive federal funding or contracts. The purpose of the bond is to provide assurance that the contractor will pay all suppliers, subcontractors, and laborers involved in the project.

The SF 274 form sets out the terms of the reinsurance agreement between the surety company issuing the bond and its reinsurer. Reinsurance is essentially insurance for insurers — it transfers risk from one insurer to another. In this case, if a claim is made against a payment bond issued by a surety company, and it pays out on that claim, it can recover some of those costs by filing a claim with its reinsurer.

Overall, completing an SF 274 form correctly ensures compliance with federal regulations governing payment bonds on federally funded construction projects. It provides protection for both parties involved in the reinsurance agreement and helps ensure prompt payment to all parties involved in construction projects covered by Bonds Statute Payment Bonds.

What is the Purpose of the SF 274 Form?

The SF 274 form is a crucial document used to record and track reinsurance agreements for Bonds Statute Payment Bonds. This document contains information about the surety who issues the bond, the reinsured company, and the amount of coverage provided by the reinsurer. The purpose of this form is to ensure that all parties involved in a payment bond agreement are aware of their obligations and responsibilities.

The SF 274 form plays an essential role in protecting both the obligee and contractor in case of default or non-payment. In such instances, it allows for prompt resolution without legal action being taken against either party. Moreover, it provides transparency between all parties involved in a payment bond agreement, ensuring that each party understands their respective roles and obligations.

In conclusion, obtaining an SF 274 form not only ensures compliance with federal regulations but also helps create transparency among those involved in reinsurance agreements for Bonds Statute Payment Bonds. Its importance cannot be overstated as it serves as an assurance that projects get completed on time while safeguarding all parties involved from any legal repercussions.

Where Can I Find an SF 274 Form?

When it comes to finding an SF 274 form, there are a few places you can look. One option is to reach out to the federal agency that requires the bond in question. They may be able to provide you with the form or direct you where to find it. Another option is to check online resources such as government websites or forms databases.

In addition, some insurance companies may have access to SF 274 forms as they often handle reinsurance agreements for bonds and other types of surety. It’s worth checking with your insurance provider if they can assist you in obtaining the necessary form for your specific needs.

Overall, while searching for an SF 274 form may be a bit challenging, there are several avenues available for obtaining this important document required for certain types of bonds and reinsurance agreements.

SF 274 Form – Reinsurance Agreement for a Bonds Statute Payment Bond

The SF 274 form is a reinsurance agreement that applies to bonds statute payment bonds. The purpose of the form is to ensure that the surety company providing the original bond has adequate financial backing in case of a claim against the bond. Essentially, it’s insurance for insurance.

The SF 274 form outlines the terms of the reinsurance agreement, including how much coverage is being provided and what events would trigger a claim under the policy. It also specifies who will be responsible for handling claims and making payments in case of default or non-performance by either party.

It’s important for both parties involved in a bonds statute payment bond transaction to understand the implications of signing an SF 274 form. For surety companies, it provides peace of mind knowing they have additional financial support should something go wrong with the original bond. For contractors or other parties seeking bonding, it could mean higher premiums or stricter qualifications as surety companies seek more protection through reinsurance agreements like this one.

SF 274 Form Example