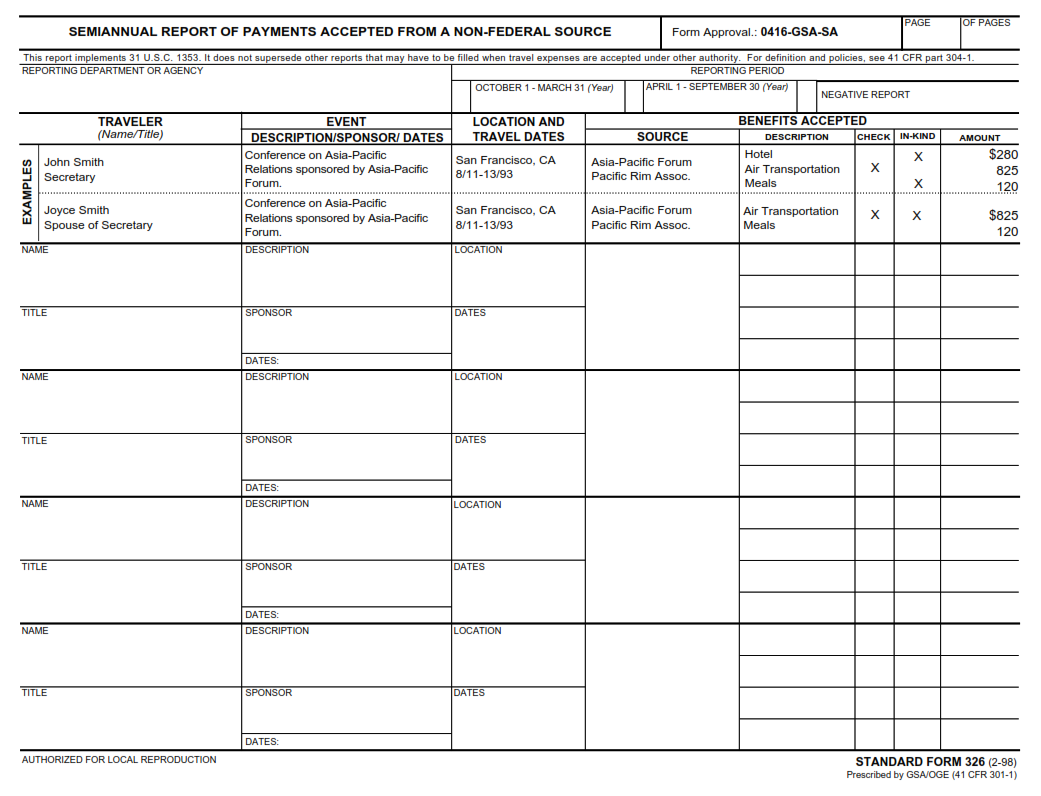

SFFORMS.COM – SF 326 Form – Semiannual Report of Payments Accepted from a Non-Federal Source – This semiannual report of payments accepted from a non-federal source summarizes all payments received by the Federal government during the preceding six months. The SF 326 form is used to report payments made to individuals and businesses, as well as taxes and royalties received. This report helps Federal agencies keep track of their financial obligations and can help taxpayers identify any deductions or credits they may be entitled to.

Download SF 326 Form – Semiannual Report of Payments Accepted from a Non-Federal Source

| Form Number | SF 326 Form |

| Form Title | Semiannual Report of Payments Accepted from a Non-Federal Source |

| File Size | 639 KB |

| Date | 02/1998 |

What is an SF 326 Form?

The SF 326 form is an essential document required by the government to track payments received from non-federal sources. The form contains detailed information such as the date of payment, amount, source of payment and purpose for which it was received. Recipients of grants and cooperative agreements funded by federal agencies are required to submit this report on twice a year; January 30th and July 30th.

The semiannual report is expected to be submitted electronically via the Payment Management System (PMS). In addition to submitting the report, recipients must also maintain records of all non-federal source funds that were accepted during each reporting period. The records should include documentation such as bank statements, receipts or cancelled checks that support the reported amounts.

Failure to submit accurate reports within stipulated time frames can result in issues such as late fees or suspension of future funds. Therefore, it’s crucial that recipients ensure timely submission and accuracy when filing their SF 326 forms.

What is the Purpose of the SF 326 Form?

The SF 326 form is a tool used by federal employees to report any payments they have received from non-federal sources. The purpose of this form is to ensure transparency and accountability in government service. It helps prevent conflicts of interest and ensures that government employees are not unduly influenced by outside interests.

The SF 326 must be filed twice a year, on January 31st and July 31st, for each employee who has received payments from non-federal sources during the reporting period. These payments can include honoraria, travel expenses, or other gifts. Failure to file the SF 326 can result in disciplinary action, including termination.

Overall, the SF 326 serves an important role in maintaining ethical standards within the federal government. By requiring employees to disclose any outside payments they receive, it helps prevent corruption and ensures that public officials are working solely for the benefit of their constituents.

Where Can I Find an SF 326 Form?

The SF 326 form is a critical document that individuals or entities with non-federal clients must fill out regularly. It’s a semiannual report of payments received from non-federal sources. The government needs this information to ensure that the individual or entity receiving these payments isn’t also getting money from federal sources, which could lead to conflicts of interest.

If you’re looking for an SF 326 form, it’s essential to know where to find one. Luckily, there are several options available online. You can visit the official website of the General Services Administration (GSA), which provides all forms needed by federal agencies and organizations.

You can also download an SF 326 form from many other websites that offer government forms and publications for free. These sites include PDFfiller, U.S Legal Forms, and others. Additionally, your employer or client may provide you with an SF 326 form if they require you to fill one out regularly.

SF 326 Form – Semiannual Report of Payments Accepted from a Non-Federal Source

The SF 326 Form is a mandatory requirement for all federal employees to report payments received from non-federal sources twice a year. The report covers gifts, travel reimbursements, honoraria or any other payments that exceed $200 in value. This form serves as a tool for transparency and accountability in how government officials accept donations and gifts.

The submission of the SF 326 Form is crucial because it ensures that elected officials are not influenced by individuals or organizations attempting to gain an unfair advantage through gift-giving. Furthermore, the forms submitted annually help the public keep track of who is giving money to elected officials and what they may expect in return for their generosity. In short, this semiannual report allows citizens to hold public officials accountable while promoting ethical decision-making within our government structures.

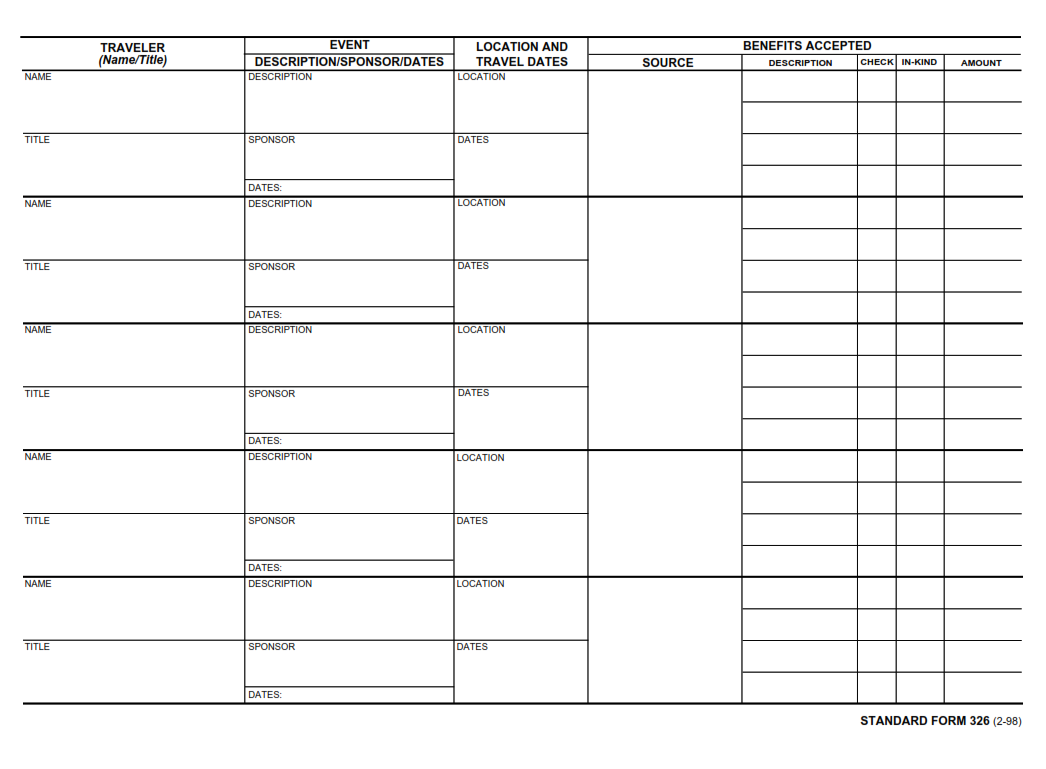

SF 326 Form Example