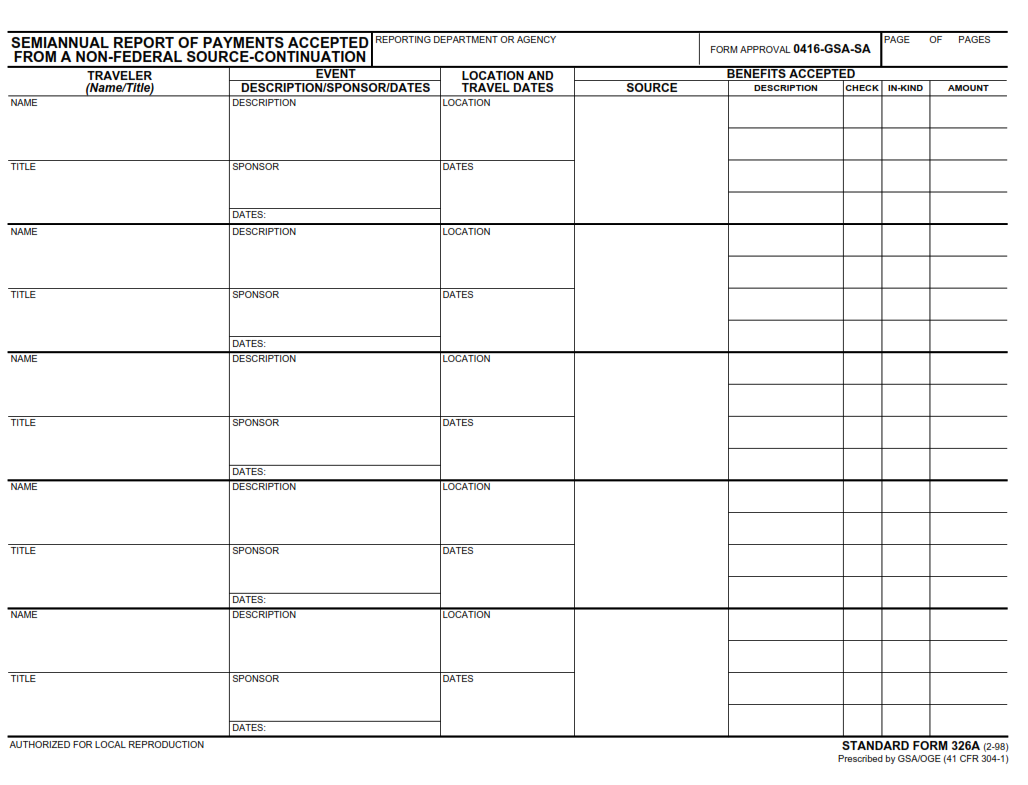

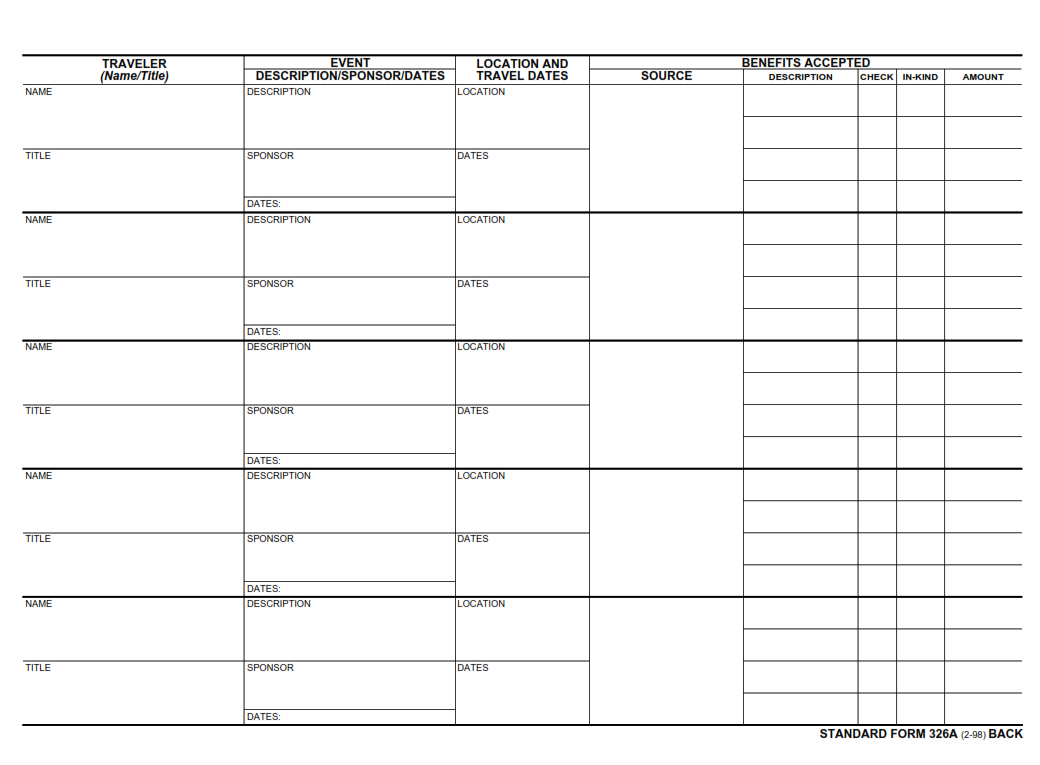

SFFORMS.COM – SF 326A Form – Semiannual Report of Payments Accepted from a Non-Federal Source – Continuation – This form is to be completed by organizations receiving payments from a non-federal source. The first sentence reports the total dollar value of payments received during the reporting period. The next two sentences report the number of payments received and the number of payments accepted, respectively. The last sentence is a continuation of the previous sentence and reports the total dollar value and number of accepted payments for the 3 months following the end of the reporting period.

Download SF 326A Form – Semiannual Report of Payments Accepted from a Non-Federal Source – Continuation

| Form Number | SF 326A Form |

| Form Title | Semiannual Report of Payments Accepted from a Non-Federal Source – Continuation |

| File Size | 556KB |

| Date | 02/1998 |

What is an SF 326A Form?

The SF 326A Form is a semi-annual report that documents payments received from non-federal sources. It is required by individuals and organizations who receive money or other types of benefits from non-governmental sources as part of their work with the federal government. The form provides information about the amounts, sources, and purposes of these payments.

The SF 326A Form is an important tool for promoting transparency in government operations. It helps to ensure that federal employees are not unduly influenced by outside interests and that public trust in government remains high. Failure to file the form can result in disciplinary action against federal employees or fines for contractors.

Overall, the SF 326A Form serves as a critical component of maintaining ethical standards within government activities. By requiring individuals to disclose any payments they receive from outside entities, it promotes accountability and transparency while also protecting the integrity of the decision-making process.

What is the Purpose of the SF 326A Form?

The SF 326A form is an essential document used by federal employees who have received payments from non-federal sources. The purpose of the form is to ensure that government officials do not receive any undue financial benefits or incentives in exchange for their public service. By requiring federal employees to disclose the payments they received, the government can ensure that there are no conflicts of interest or ethical violations.

The SF 326A form must be completed and submitted twice a year to prevent any potential conflicts of interest from arising during the course of an employee’s tenure in office. This requirement applies to all federal employees, including part-time workers and even those on leave-without-pay status. The information disclosed on the SF 326A Form is publicly available online and serves as a key transparency measure for government accountability.

In conclusion, the SF 326A form plays a crucial role in maintaining transparency and ethical conduct within our government institutions. Its purpose is to ensure that federal employees are held accountable for any payments they receive from non-federal sources while serving in their official capacities. Without this system, we would not have access to important financial information about our elected officials and other government representatives.

Where Can I Find an SF 326A Form?

The SF 326A form is a vital document that records payments accepted from non-federal sources. If you’re looking to obtain this document, there are several ways to go about it. The first and most accessible option is to download the SF 326A form from the official website of the General Services Administration (GSA). This website provides access to all kinds of government forms and documents, including the SF 326A form.

Another way to acquire an SF 326A form is through contacting your respective federal agency or department’s finance office. Typically, agencies and departments have a centralized finance department that manages all financial transactions within their organization. You can reach out to them either via email or phone call and request an SF 326A form.

In conclusion, obtaining an SF 326A form isn’t difficult as long as you know where to look for it. By visiting GSA’s official website or reaching out to your respective agency’s finance office, you can easily obtain a copy of this important financial documentation for your records.

SF 326A Form – Semiannual Report of Payments Accepted from a Non-Federal Source – Continuation

The SF 326A form is a critical document that must be submitted by all government employees who have received payments from non-federal sources. It is a semiannual report that captures all the details of the funds received, including the source and amount. The information provided in this form helps to ensure transparency and accountability among government officials while maintaining integrity in public service.

The continuation of the SF 326A form requires similar information as its initial submission, with an addition of new financial transactions made during the reporting period. It is essential to note that failure to submit this report could compromise one’s position in their respective agency or organization. Furthermore, it could lead to legal implications due to non-compliance with established rules and regulations governing payment acceptance from non-federal sources.

In conclusion, submitting the SF 326A Form Continuation is crucial not only for compliance purposes but also for transparency and accountability within governmental agencies. As such, it’s necessary for all government employees receiving payments from non-federal sources to understand their obligations regarding this document’s timely submission. By adhering to these reporting requirements, we can help maintain trust between citizens and our public institutions while upholding high standards of ethical behavior among our leaders.

SF 326A Form Example