SFFORMS.COM – SF 329A Form – Wage Garnishment Letter and Important Notice to Employer – Employers need to be aware of the SF 329A form and how it can be used to garnish an employee’s wages. The notice to employer included with the form is very important, as it contains important information about when and how wage garnishment will take place.

Download SF 329A Form – Wage Garnishment Letter and Important Notice to Employer

| Form Number | SF 329A Form |

| Form Title | Wage Garnishment Letter and Important Notice to Employer |

| File Size | 300 KB |

| Date | 01/2005 |

What is an SF 329A Form?

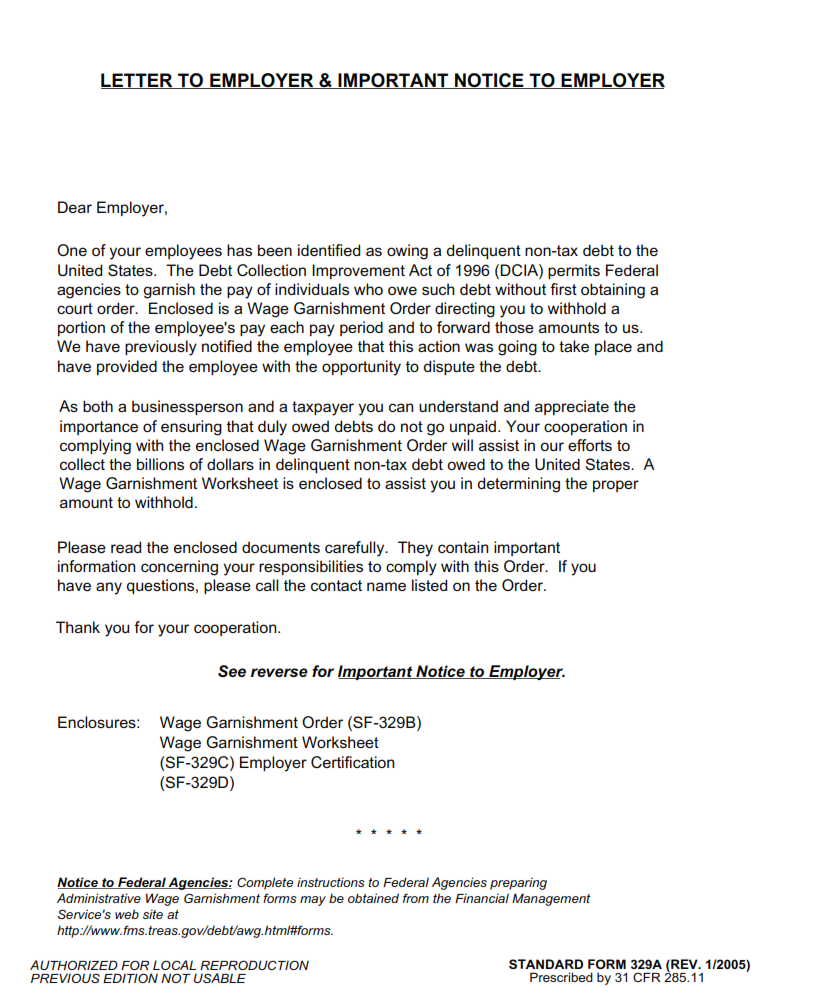

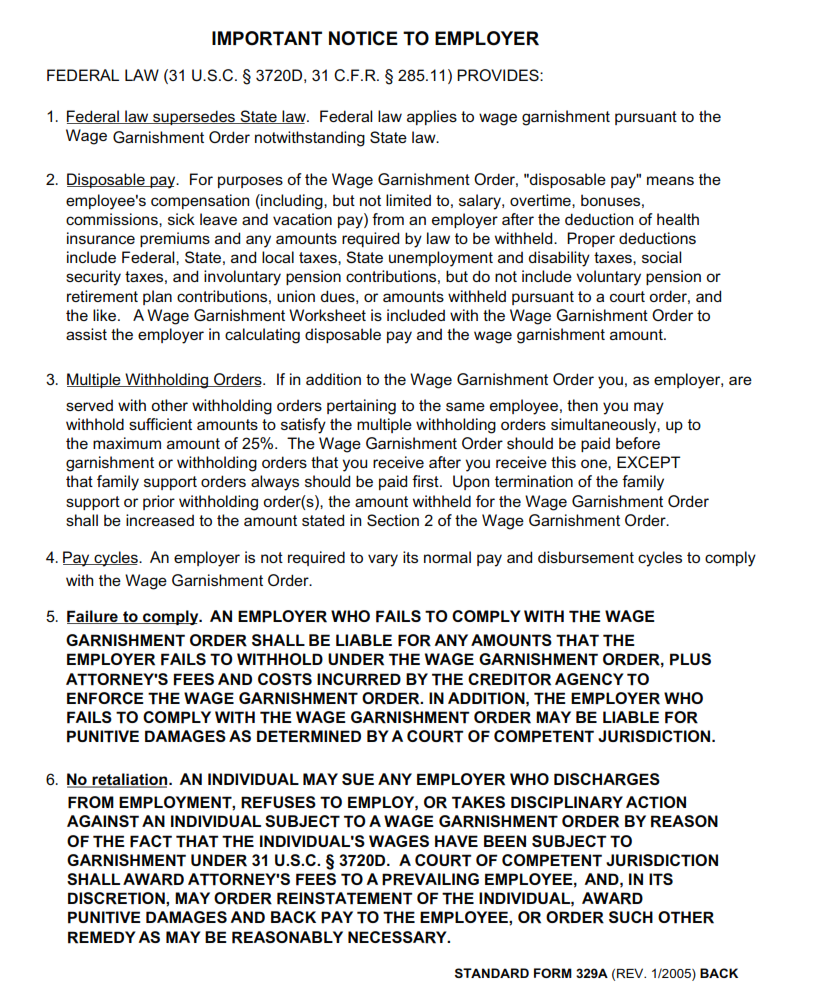

The SF 329A Form is a Wage Garnishment Letter and Important Notice to Employer that informs an employer about an employee’s wage garnishment. It is a legal document that directs the employer to withhold a specific amount of money from the employee’s paycheck, which will be sent directly to a creditor or agency. The purpose of this form is to ensure that creditors are paid back for debts owed by employees.

The SF 329A Form has strict guidelines that employers must follow, as failing to do so can result in penalties and fines. The form includes information such as the amount being garnished, the creditor or agency requesting the garnishment, and how long the garnishment will last. Employers must also provide their own contact information on the form and keep accurate records of all garnishments made.

It is important for both employers and employees to understand the implications of receiving an SF 329A Form. Employees may want to seek legal advice if they believe their wages are being unfairly garnished, while employers should ensure they comply with all regulations related to wage garnishments.

What is the Purpose of the SF 329A Form?

The SF 329A form is a legal document that serves as an important notice to employers when their employees are subjected to wage garnishment. The purpose of the SF 329A form is to inform the employer about the employee’s financial obligations and how much money should be withheld from their wages. This form is issued by the government or a court order, and it helps ensure that all parties involved in wage garnishment follow proper procedures.

Employers who receive an SF 329A form must take immediate action by withholding the specified portion of their employee’s wages until they have paid off their debts in full. It is essential for employers to comply with this legal document, as failing to do so can result in serious legal consequences. Wage garnishments can also be very disruptive for employees, and employers should strive to handle them with discretion and sensitivity.

In summary, the SF 329A form plays a crucial role in ensuring that wage garnishments are handled correctly and responsibly. Employers must understand their responsibilities under this legal document and work closely with all parties involved to ensure compliance with its requirements while minimizing disruption for affected employees.

Where Can I Find an SF 329A Form?

The SF 329A form is a vital document that helps individuals communicate with their employers about wage garnishment. This form can be used to inform your employer about an order for wage garnishment, the amount of wages that need to be withheld, and the duration of the withholding period. It also serves as an important notice to employers regarding their legal obligations under federal law.

If you are looking for an SF 329A form, there are several places where you can find it. One option is to visit the official website of the United States Courts or contact your local court clerk’s office. You may also be able to obtain this form from your attorney or through online legal document services.

It is important to note that filling out this form correctly and providing all necessary information can help ensure that your employer complies with wage garnishment orders and avoids any penalties or legal issues. Therefore, taking time to understand how to properly complete and submit this form is crucial for anyone facing a wage garnishment situation.

SF 329A Form – Wage Garnishment Letter and Important Notice to Employer

The SF 329A form is a wage garnishment letter and important notice to employers that an employee’s wages will be garnished. This form is typically issued by the IRS or other government agencies to collect unpaid taxes, student loans, or child support payments. Employers are required by law to comply with the wage garnishment order and withhold a certain amount of the employee’s wages until the debt is paid off.

It is important for employers to review the SF 329A form carefully and ensure that they understand their responsibilities as outlined in the notice. Employers must calculate and withhold the correct amount of funds, which can be challenging if multiple wage garnishments are in place for one employee. Additionally, employers must communicate with employees about their rights as well as any potential impacts on their paychecks.

In conclusion, receiving an SF 329A form can be stressful for both employers and employees. However, by understanding their respective responsibilities and communicating clearly with each other, both parties can navigate through this process effectively.

SF 329A Form Example