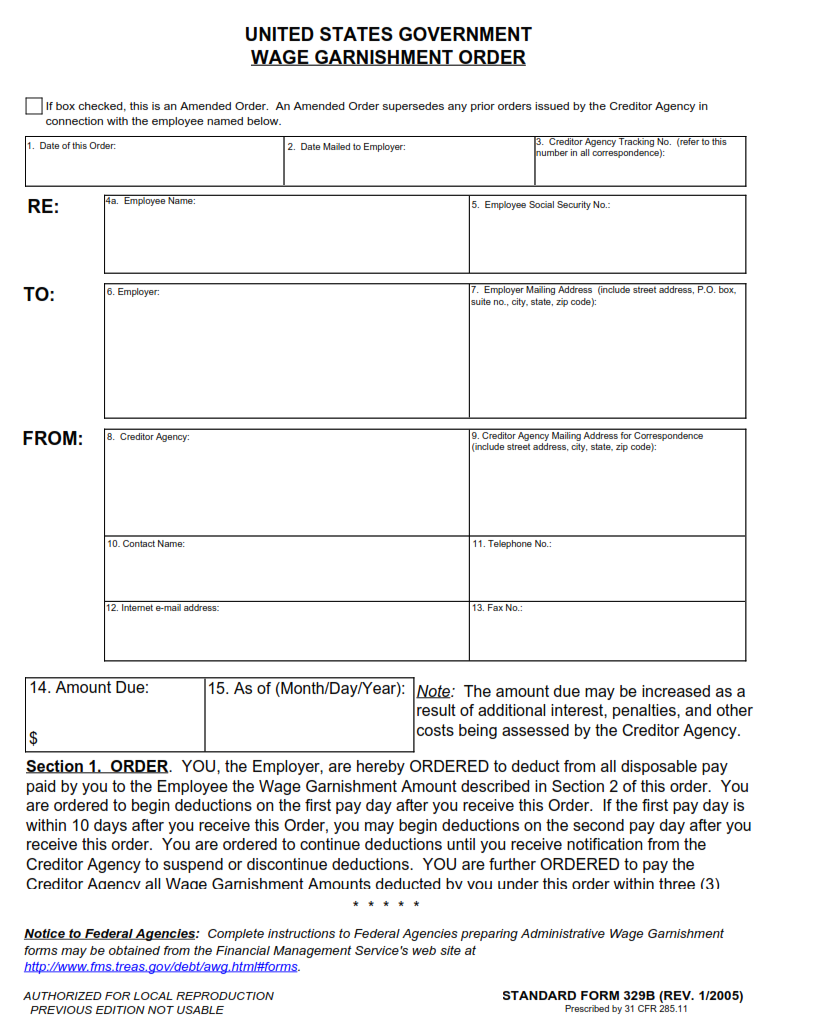

SFFORMS.COM – SF 329B Form – Wage Garnishment Order – If you are being garnished wages, you may be wondering what the wage garnishment order is. The wage garnishment order is a document that outlines the information your employer must provide to the wage garnishment agency. This document can include your name, Social Security number, and wages that have been garnished.

Download SF 329B Form – Wage Garnishment Order

| Form Number | SF 329B Form |

| Form Title | Wage Garnishment Order |

| File Size | 2 MB |

| Date | 01/2005 |

What is a SF 329B Form?

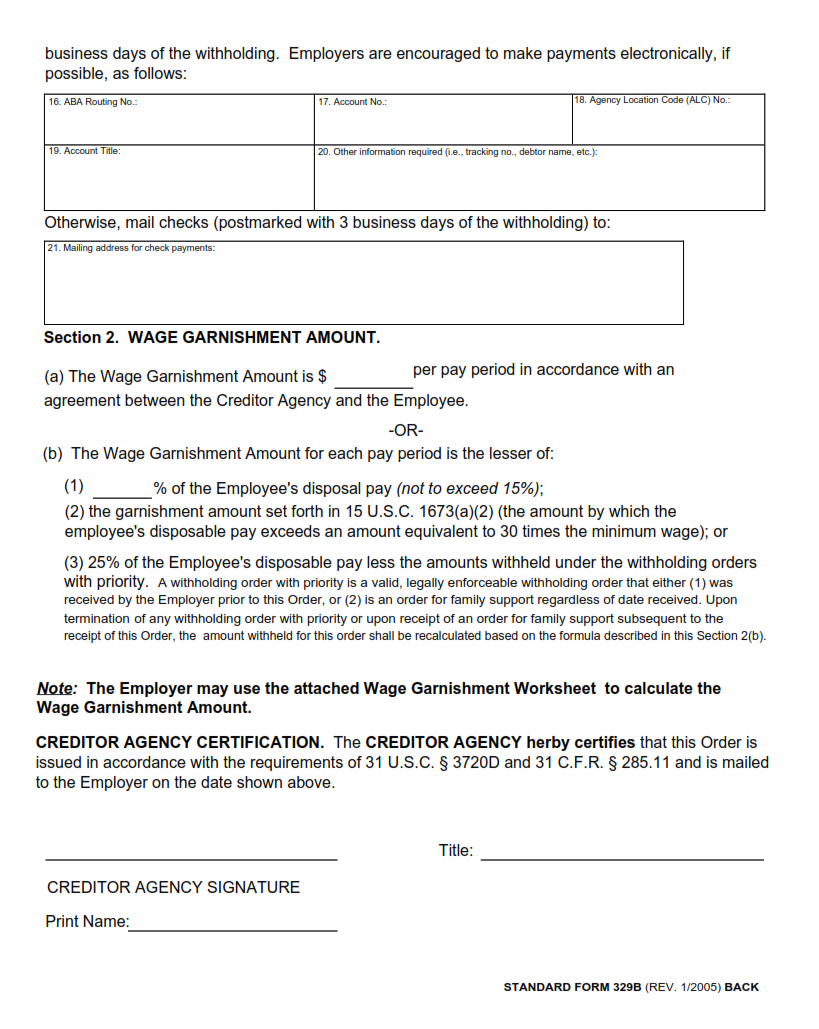

The SF 329B form is a legal document used to instruct an employer to withhold a portion of an employee’s wages for the purpose of paying off a debt or judgment. This process, known as wage garnishment, is typically used by creditors and government agencies to collect unpaid debts such as taxes or student loans. The form requires detailed information about the debtor, including their current employer and earnings.

Once completed, the SF 329B form is served on the employer who must then begin withholding wages according to the instructions provided. Generally, federal law allows up to 25% of disposable income to be withheld for most types of debts. However, certain debts such as child support may have higher limits.

It’s important for employees facing wage garnishment to understand their rights under federal and state laws. Employers are prohibited from retaliating against employees who have had wages withheld due to garnishment orders. Additionally, there are exemptions available that may protect some or all of an individual’s wages from being garnished based on their financial situation.

What is the Purpose of SF 329B Form?

The SF 329B Form is a legal document that authorizes the collection of a certain amount of an employee’s salary or wages in order to pay off outstanding debts. This form is typically used in cases where there is a court order for wage garnishment, such as unpaid taxes, child support, or other debts that have been legally ordered. Employers are required to comply with this order and withhold the specified amount from their employees’ paychecks until the debt has been paid off.

The purpose of the SF 329B Form is to ensure that creditors receive payment for debts owed by an individual who may be unwilling or unable to make payments on their own. It provides a legal mechanism for collecting these debts by allowing employers to withhold money directly from an employee’s paycheck. This form helps streamline the process for both creditors and employers while protecting the rights of employees who may be struggling financially but still need to provide for themselves and their families. Overall, this form plays an important role in debt collection efforts and ensures that individuals meet their financial obligations.

Where Can I Find a SF 329B Form?

The SF 329B form is a legal document that serves as a wage garnishment order. It is used by the United States government to collect delinquent debts owed by individuals or businesses. The form authorizes an employer to withhold a portion of an employee’s wages and send it directly to the government agency that is owed the debt.

If you need to obtain a copy of the SF 329B form, there are several ways to do so. One option is to visit your local courthouse or government office and request a copy in person. You can also download the form from the official website of the United States Courts or from various other online resources.

It’s important to note that filling out and submitting this form should not be taken lightly, as it involves legal action against an individual’s income. If you are unsure about how to proceed with wage garnishment, it may be helpful to consult with an attorney who specializes in debt collection laws and procedures.

SF 329B Form – Wage Garnishment Order

The SF 329B Form, also known as the Wage Garnishment Order form, is a legal document used to order an employer to withhold wages from an employee’s paycheck in order to satisfy a debt. This form can only be issued by a court or government agency and must comply with federal and state laws.

Once an employer receives the wage garnishment order, they are required by law to begin withholding the specified amount from the employee’s paycheck until the debt is paid off or until they receive further instructions from the court or agency that issued the order. The employer is also responsible for keeping accurate records of all payments made towards the debt.

It’s important for both employers and employees to understand their rights and responsibilities when it comes to wage garnishment orders. Employers must ensure they comply with all legal requirements and provide proper notice to their employees, while employees should seek legal advice if they believe their wages are being improperly garnished or if they have any questions about their rights under this process.

SF 329B Form Example