SFFORMS.COM – SF 329C Form – Wage Garnishment Worksheet – This SF 329C form is a wage garnishment worksheet that can help you calculate your total wage garnishment amount. This worksheet includes information about your income, deductions and credits, and the amount of your wages that will be subject to garnishment.

Download SF 329C Form – Wage Garnishment Worksheet

| Form Number | SF 329C Form |

| Form Title | Wage Garnishment Worksheet |

| File Size | 323 KB |

| Date | 11/1998 |

What is a SF 329C Form?

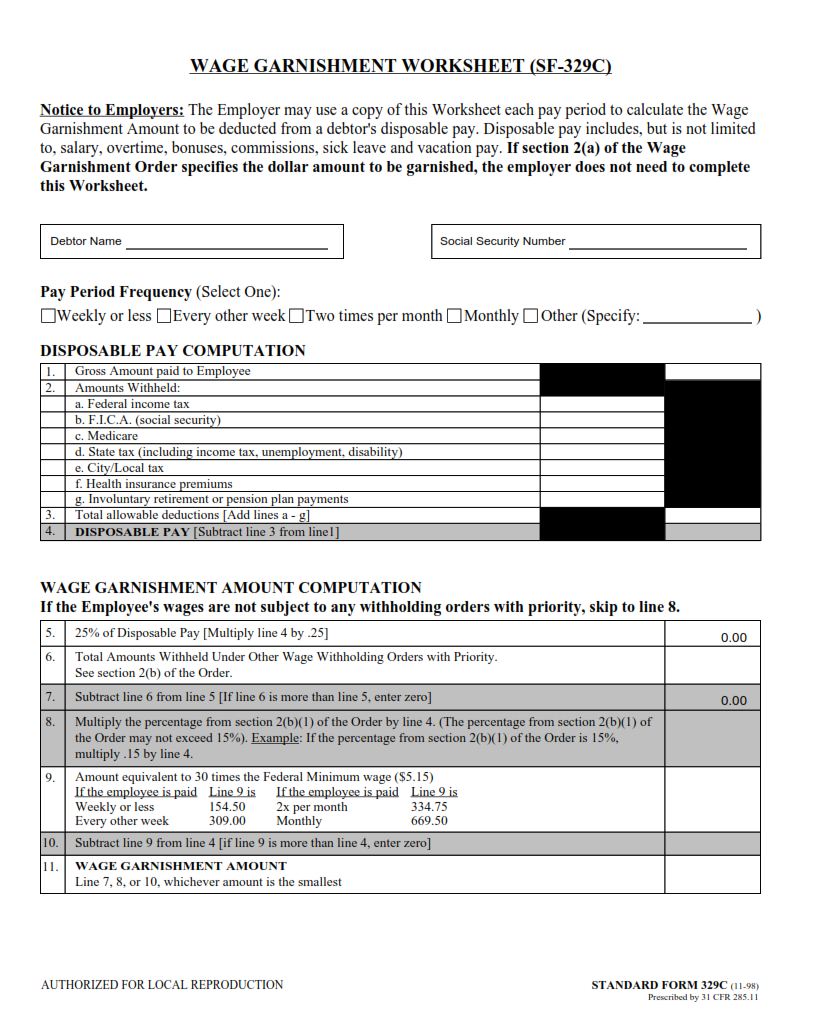

The SF 329C form is commonly known as the Wage Garnishment Worksheet. It is a government document used by employers to calculate the amount of money that needs to be withheld from an employee’s paycheck in order to satisfy a court-ordered wage garnishment. The worksheet provides detailed instructions for completing the necessary calculations, including formulas for determining taxable wages and deductions.

The SF 329C form is used in cases where an individual owes a debt or judgment that has been ordered by a court. A creditor can obtain a court order for wage garnishment, which requires the employer to withhold a portion of the employee’s earnings until the debt is paid off. The Wage Garnishment Worksheet helps ensure that the correct amount of wages are withheld and paid over to the creditor.

It is important for employers to follow all guidelines provided on the SF 329C form when calculating wage garnishments, as failure to do so could result in legal consequences. Employees who have questions about their wage garnishments should consult with their employer or seek legal advice from an attorney specializing in employment law.

What is the Purpose of SF 329C Form?

The SF 329C form is an essential document for employers and employees dealing with wage garnishment. The main purpose of this form is to calculate the amount of disposable income that can be garnished from an employee’s wages by a creditor or debt collector. This calculation is based on the employee’s income, tax status, and other deductions.

The SF 329C form helps both employers and employees stay compliant with federal regulations related to wage garnishment. It ensures that the correct amount of money is withheld from an employee’s paycheck each pay period, which protects employers from legal action taken by creditors if they fail to withhold the appropriate amount.

Overall, the SF 329C form plays a crucial role in ensuring that wage garnishment proceedings are handled correctly and fairly for all parties involved. Employers must have accurate information about their employees’ disposable income in order to properly execute wage garnishments, and this form provides just that.

Where Can I Find a SF 329C Form?

If you are facing wage garnishment, it is important to know your rights and responsibilities. One of the key documents that you will need is the SF 329C form, also known as the Wage Garnishment Worksheet. This form is used by employers to calculate how much money should be withheld from your paycheck each pay period in order to satisfy a debt or other financial obligation.

There are several places where you can find a SF 329C form online. The easiest way is to visit the official website of the United States Courts, which provides access to all federal court forms including the SF 329C. You can also try searching for “SF 329C” on popular search engines like Google or Bing – this will often lead you to links for free downloads of the form.

If you are still having trouble finding a SF 329C form online, you may want to consider contacting your local courthouse or attorney’s office for assistance. They may have copies available that they can provide to you either in person or via email. Whatever route you choose, be sure to fill out the form completely and accurately before submitting it to your employer so that wage garnishment can begin promptly and efficiently.

SF 329C Form – Wage Garnishment Worksheet

The SF 329C form is used by employers to calculate the amount of wages that can be withheld from an employee’s paycheck for wage garnishment. This form is typically issued by the court or other government agency that has authorized the wage garnishment. The employer must complete and return the form within a specified time frame to ensure compliance with the court order.

The wage garnishment worksheet on SF 329C provides instructions for calculating how much money should be withheld from each paycheck, based on factors such as the employee’s gross earnings and any pre-existing deductions. It also includes information about exemptions that may apply, such as those related to child support or federal taxes.

Overall, completing the SF 329C form accurately and in a timely manner is essential for both employers and employees involved in wage garnishment cases. Employers who fail to comply with court orders may face legal consequences, while employees may experience further financial hardship if their wages are not properly calculated and withheld according to law.

SF 329C Form Example