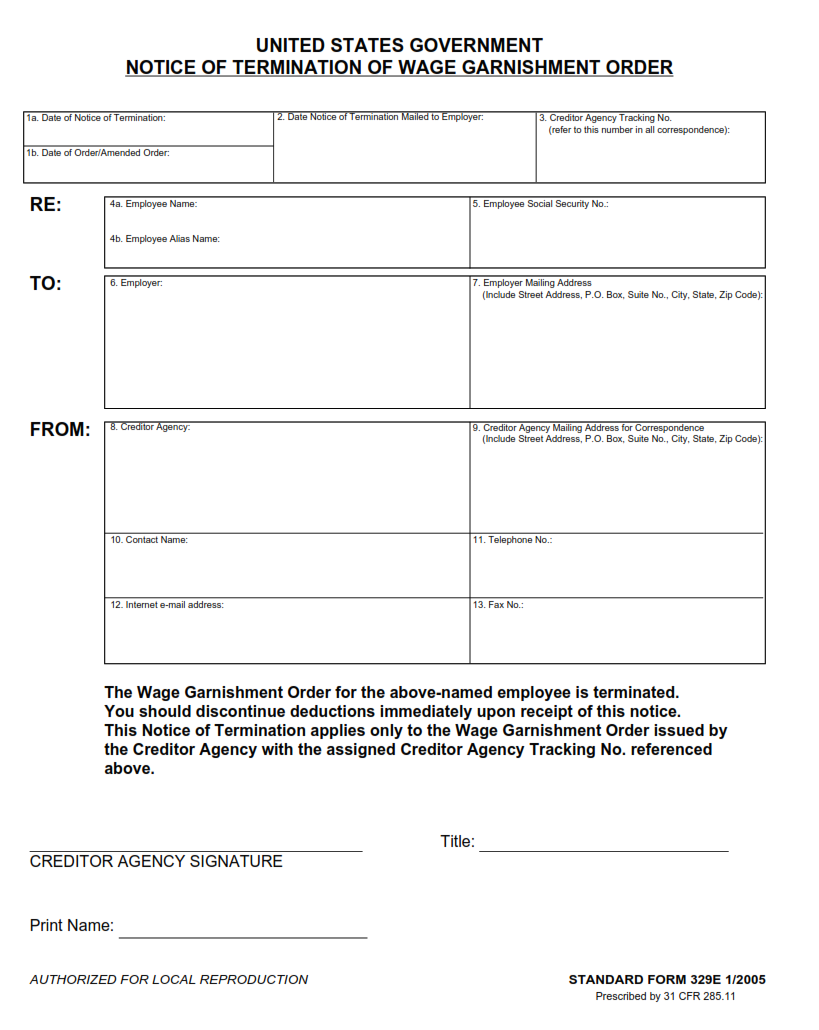

SFFORMS.COM – SF 329E Form – Notice of Termination of Wage Garnishment Order – The SF 329E form is used to notify the person wage garnishment is being terminated. The form should be sent to the person’s last known address, if different from their current address. If the person receiving the notice can’t be reached, then the form should be sent to their attorney. The form must include a statement that wage garnishment is being terminated and why.

Download SF 329E Form – Notice of Termination of Wage Garnishment Order

| Form Number | SF 329E Form |

| Form Title | Notice of Termination of Wage Garnishment Order |

| File Size | 541 KB |

| Date | 01/2005 |

What is a SF 329E Form?

The SF 329E Form is a legal document used to terminate the wage garnishment order. It is issued by the agency that initiated the garnishment request and sent to your employer or financial institution. Once this form has been received, your employer or bank will be notified that they are no longer required to withhold a portion of your wages.

The form contains important information such as the date when the garnishment began, how much money was withheld from your paycheck or account, and any outstanding balance owed. You should keep a copy of this form for your records in case there are any discrepancies in future payments.

It is essential to file an SF 329E Form if you want to stop wage garnishment legally. Failure to do so can result in further legal action against you, including fines and penalties. If you have any questions about this process or need assistance with filling out the form correctly, it’s best to consult with an attorney who specializes in wage garnishments.

What is the Purpose of SF 329E Form?

The SF 329E form is a legal document used to terminate wage garnishments. It is filed by employers when they receive an order to withhold wages from an employee’s paycheck in order to repay debt or other dues. Once the employer receives this notice of termination, they are no longer required to withhold any wages from the employee’s paycheck.

The main purpose of the SF 329E form is to notify both the employer and employee that a wage garnishment order has been terminated. This can happen for several reasons, such as when the debt has been paid off or if there was a mistake made in filing the garnishment in the first place. The completion and submission of this form ensures that all parties involved are aware of any changes made to their financial situation due to wage withholding.

Overall, submitting an SF 329E form is important for both employees and employers as it helps keep track of wage garnishments accurately and ensures that proper payments are made without confusion or mistakes.

Where Can I Find a SF 329E Form?

If you’re looking for a SF 329E form, the first place to check would be the website of the agency that garnished your wages. Many agencies have their own websites where they make forms available for download. If you had your wages garnished by an employer, you may also want to check with them to see if they have a copy of the SF 329E form on file.

Another option is to visit or call your local courthouse, as some courts may have copies of this form on hand. You can also try searching online, as there are various websites that offer government forms for download. However, be cautious when downloading from third-party sites and ensure that you are getting an official version of the form.

In conclusion, while finding a SF 329E form may seem daunting at first glance, there are several avenues you can explore. Checking with the agency or employer who garnished your wages should be your first step; however, if this doesn’t work out then reaching out to local courthouses or conducting an online search could also prove helpful in obtaining this important legal document.

SF 329E Form – Notice of Termination of Wage Garnishment Order

The SF 329E form is a legal document used to terminate a wage garnishment order. This form is specifically designed for federal employees and retirees who have had their wages garnished. The purpose of this form is to stop the deductions from their paychecks, which were made as part of a debt repayment plan.

The SF 329E form must be completed by the debtor (employee or retiree) and submitted to the creditor or agency responsible for processing the wage garnishment order. It is important to note that this form does not cancel the entire debt owed. Rather, it only terminates the wage garnishment order and stops future deductions from being made.

In addition to completing and submitting the SF 329E form, debtors should also keep copies of all documents related to their wage garnishment order, including payment receipts and correspondence with creditors or agencies. By doing so, they can avoid any confusion or misunderstandings in the future regarding their debt repayment obligations.

SF 329E Form Example