SFFORMS.COM – SF 425A Form – Federal Financial Report Attachment – for Reporting Multiple Grants – When it comes to managing multiple grants, keeping track of financial reports can be quite overwhelming. That’s why the federal government has introduced the SF 425A Form – Federal Financial Report Attachment, which is specifically designed for reporting on multiple grants. The form aims to simplify and streamline the process of submitting financial information by providing a standardized format that ensures consistency across all grant programs.

This article will provide an in-depth guide to understanding the SF 425A Form and how to properly fill it out. We’ll cover everything from what information needs to be included on the form, when it needs to be submitted, and common mistakes that should be avoided.

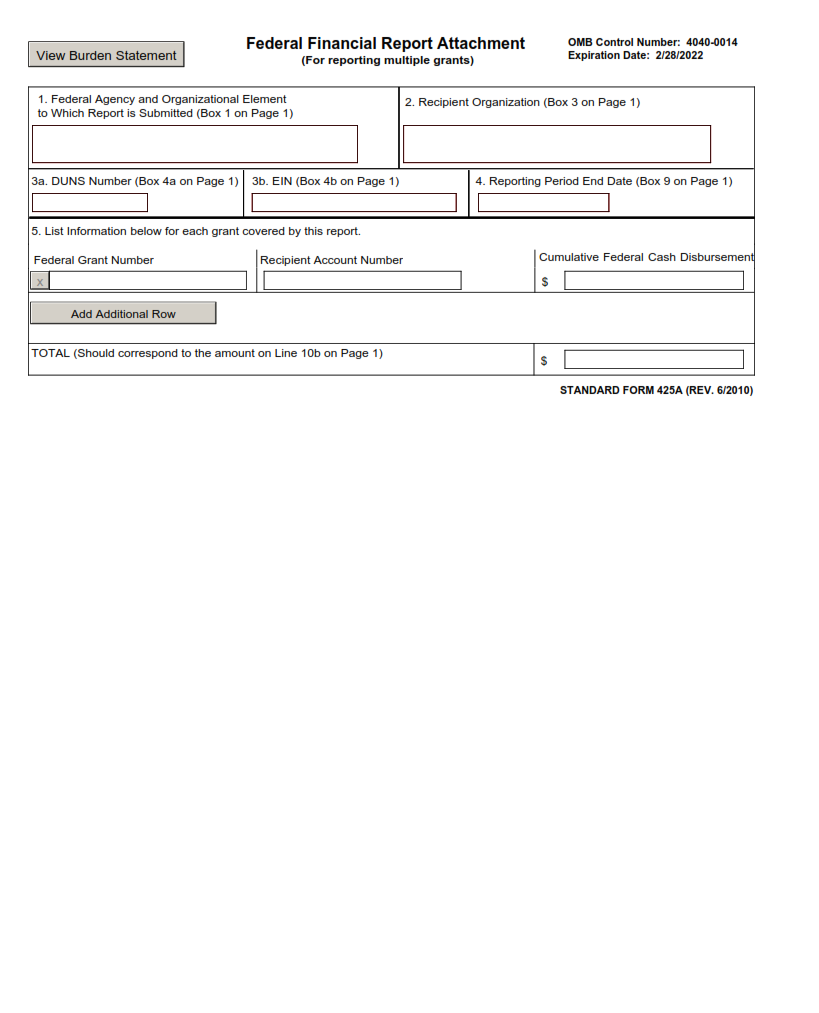

Download SF 425A Form – Federal Financial Report Attachment – for Reporting Multiple Grants

| Form Number | SF 425A Form |

| Form Title | Federal Financial Report Attachment – for Reporting Multiple Grants |

| File Size | 1 MB |

| Date | 06/2010 |

What is a SF 425A Form?

SF 425A Form is an essential document for reporting multiple grants. It is also known as the Federal Financial Report Attachment, which assists in providing financial information to the government and other funding agencies. If you are a grant recipient who has received federal funds from various sources, then SF 425A becomes a crucial form for financial reporting.

The form requires detailed information on expenses such as salaries and wages, equipment costs, travel expenses, and indirect costs incurred during the project period. It also includes revenue generated from the project or program. As a result, it helps funding agencies determine whether funds were spent appropriately and if they should continue to be granted to future projects.

SF 425A Form must be submitted annually or at the end of each grant period. The required financial information must be accurate and complete to avoid delays in processing future grants or payments. Therefore, it is essential to understand this form’s requirements thoroughly before starting any funded project that will require financial reporting.

What is the Purpose of SF 425A Form?

The SF 425A form is an essential document that is used to report financial information for multiple grants. This form is a federal financial report attachment that contains detailed information about the grant recipient’s expenditures and revenues. The purpose of this form is to provide transparency in the use of government funds and ensure compliance with relevant laws and regulations.

When filling out the SF 425A form, it is important to provide accurate and complete information about all grants received by the organization or individual. This includes details such as the grant number, period covered by the report, total amount awarded, and any changes made to the original award. Additionally, recipients must provide a breakdown of expenses incurred during the reporting period, including salaries, travel costs, equipment purchases, and other direct costs.

Overall, completing the SF 425A form accurately and on time is crucial for maintaining eligibility for future grants from federal agencies. By providing transparent financial reports that demonstrate responsible stewardship of government funds, organizations can build trust with funding agencies and ensure continued support for their programs and initiatives.

Where Can I Find a SF 425A Form?

If you’re looking for an SF 425A form, the best place to start is with the organization that provided you with your grant. Many organizations will provide a link to download the form directly from their website or may send it to you as part of your grant package. Additionally, government agencies such as the Department of Health and Human Services (HHS) may have forms available on their websites.

If you’re unable to find the SF 425A form through your grant provider or a government agency, there are other resources available. The General Services Administration (GSA) offers standardized forms for federal use, which includes the SF 425A form. These standardized forms can be found on their website.

It’s important to note that while finding the right form is crucial for reporting multiple grants accurately, completing it properly can be equally important. Organizations such as The Grantsmanship Center offer training and guidance on how to properly complete financial reports for grants. They can assist in ensuring everything is filled out correctly and submitted by the appropriate deadline.

SF 425A Form – Federal Financial Report Attachment – for Reporting Multiple Grants

The SF 425A form is an essential tool for grantees who need to report financial information on multiple grants from federal agencies. This form provides a comprehensive overview of the grantee’s financial performance and helps ensure compliance with federal regulations. Grantees must submit the SF 425A form within 90 days after the end of each calendar quarter, or as required by their funding agency.

The SF 425A form is an attachment to the Federal Financial Report (FFR), which is used to report on single grants. The form requires detailed financial information, including revenue and expenses for each grant, as well as any unliquidated obligations or cash balances. Grantees are also required to provide a narrative description of any significant changes in their financial position during the reporting period.

Overall, the SF 425A form helps streamline the reporting process for organizations receiving multiple grants from federal agencies. By consolidating financial information into one document, grantees can more easily track their spending and ensure they are meeting funding requirements. Ultimately, this leads to better accountability and transparency in government grant programs.

SF 425A Form Example