SFFORMS.COM – SF 428A Form – Tangible Personal Property Report – Annual Report – As a business owner, it’s important to keep track of all your tangible personal property and report it accurately for tax purposes. This is where the SF 428A form comes into play. The Tangible Personal Property Report, also known as the Annual Report, requires businesses to provide detailed information about their assets like machinery, equipment, furniture and fixtures.

The SF 428A form is essential for maintaining compliance with state regulations regarding the taxation of tangible personal property. Failure to file this report or providing inaccurate information could result in hefty fines or penalties. In this article, we will take a closer look at what the SF 428A form is all about and how you can ensure that your business stays compliant with government regulations.

Download VTR-267 – Additional Liens Statement

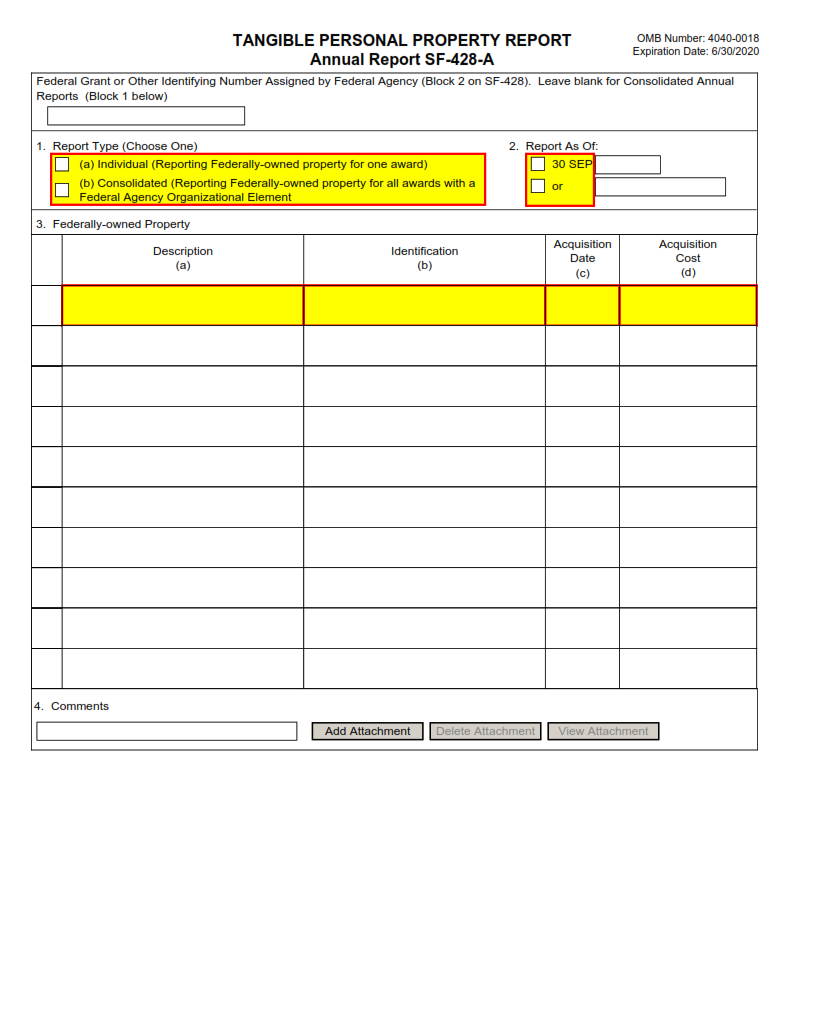

| Form Number | SF 428A Form |

| Form Title | Tangible Personal Property Report – Annual Report |

| File Size | 95 KB |

| Date | 06/2017 |

What is an SF 428A Form?

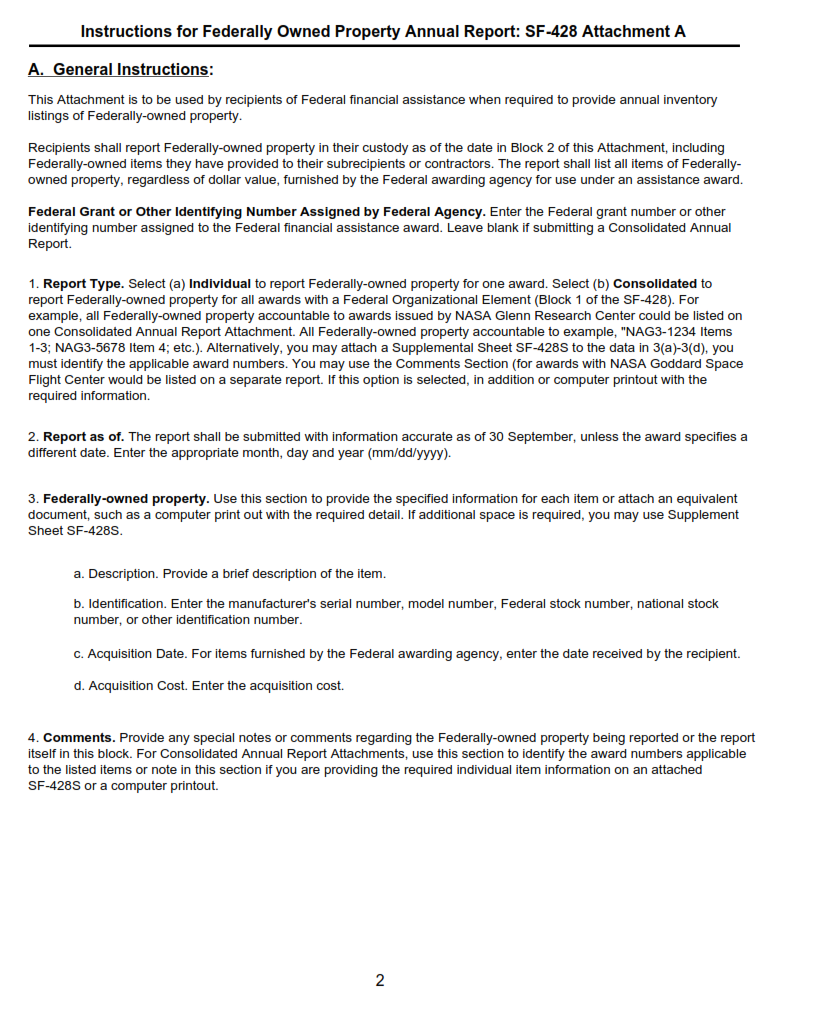

The SF 428A Form is a tangible personal property report that must be submitted annually by federal agencies and entities. This form provides information about the equipment, materials, and supplies that an agency owns or uses. It includes data on the type of property, its value, acquisition date, source of funding for its purchase, and location.

The primary purpose of the SF 428A Form is to ensure compliance with federal regulations regarding tangible personal property management. The report helps to track and monitor government-owned equipment and materials that are subject to loss or theft if not adequately managed. Additionally, it helps in planning future acquisitions by providing accurate information on existing equipment.

Failure to submit this report can have serious consequences for a federal agency or entity as it may result in a violation of the regulations governing federal property management. Therefore, submitting an accurate and timely SF 428A Form is essential for any organization receiving funding from the government.

What is the Purpose of the SF 428A Form?

The SF 428A Form, also known as the Tangible Personal Property Report, is an annual report that federal agencies are required to file with the General Services Administration (GSA). The purpose of this form is to provide information on tangible personal property owned or leased by federal agencies. This includes items such as office equipment, furniture, and vehicles.

By filing this report annually, federal agencies can ensure that they are properly accounting for their tangible personal property and complying with regulations set forth by the Federal Property Management Regulations. It also allows the GSA to maintain an accurate inventory of all federal government-owned property.

This form requires detailed information on each item of tangible personal property including its description, location, condition, and acquisition cost. Any changes in ownership or disposition must also be reported on subsequent reports. Overall, the SF 428A Form serves as a crucial tool for both federal agencies and the GSA in managing and tracking tangible personal property across government entities.

Where Can I Find an SF 428A Form?

The SF 428A Form is a tangible personal property report that organizations and businesses are required to submit annually. This form is essential because it lists the value of any personal property that an organization has acquired or disposed of throughout the year. The report helps government agencies track and monitor the transfer of personal property, which can be used for tax purposes and other legal matters.

If you need to file an SF 428A Form, there are several ways you can obtain one. The most straightforward way is by visiting the General Services Administration (GSA) website, where you can download a PDF version of the form. Alternatively, you could contact your local GSA office or visit their website to request a copy. Some states may also have their versions of this form; in such cases, it’s best to check with your state department before filing.

In conclusion, if you’re wondering where to find an SF 428A Form, know that it’s readily available on the GSA website. It’s crucial to file this annual report accurately and on time since failing to do so can result in penalties or even legal action against your organization or business.

SF 428A Form – Tangible Personal Property Report – Annual Report

The SF 428A form is an annual report filed by businesses and organizations to report their tangible personal property. Tangible personal property refers to assets that can be touched or moved such as furniture, machinery, equipment, and inventory. This form helps the government assess and collect taxes on these properties.

The SF 428A form must be filed annually by April 15th with the county assessor where the property is located. Failure to file this form on time may result in penalties and interest. Businesses are responsible for reporting all of their taxable tangible personal property even if they have changed ownership during the year.

It’s important for businesses to review their tangible personal property each year to ensure accurate reporting on the SF 428A form. Accurate reporting not only helps avoid penalties but also ensures fair taxation among all businesses in a given area.

SF 428A Form Example