SFFORMS.COM – SF 428B Form – Tangible Personal Property Report – Final Report – If you’re a business owner in Iowa, chances are you’ve come across the SF 428B form at some point. As part of the state’s tax laws, this form is used to report any tangible personal property owned by your business as of January 1st each year. This includes items like furniture, equipment, and supplies that are used for business purposes.

In this article, we’ll take a closer look at the SF 428B form and what it entails. We’ll discuss why it’s important to file an accurate report, how to complete the form correctly and on time, as well as any penalties for non-compliance.

Download SF 428B Form – Tangible Personal Property Report – Final Report

| Form Number | SF 428B Form |

| Form Title | Tangible Personal Property Report – Final Report |

| File Size | 122 KB |

| Date | 06/2017 |

What is an SF 428B Form?

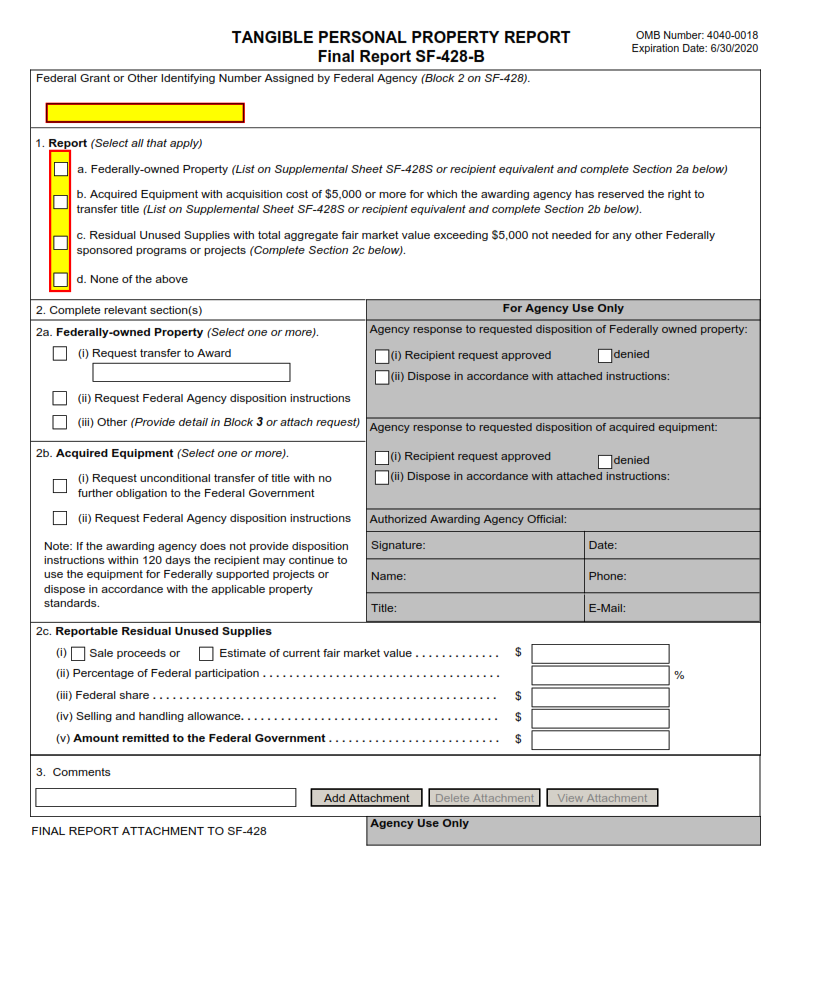

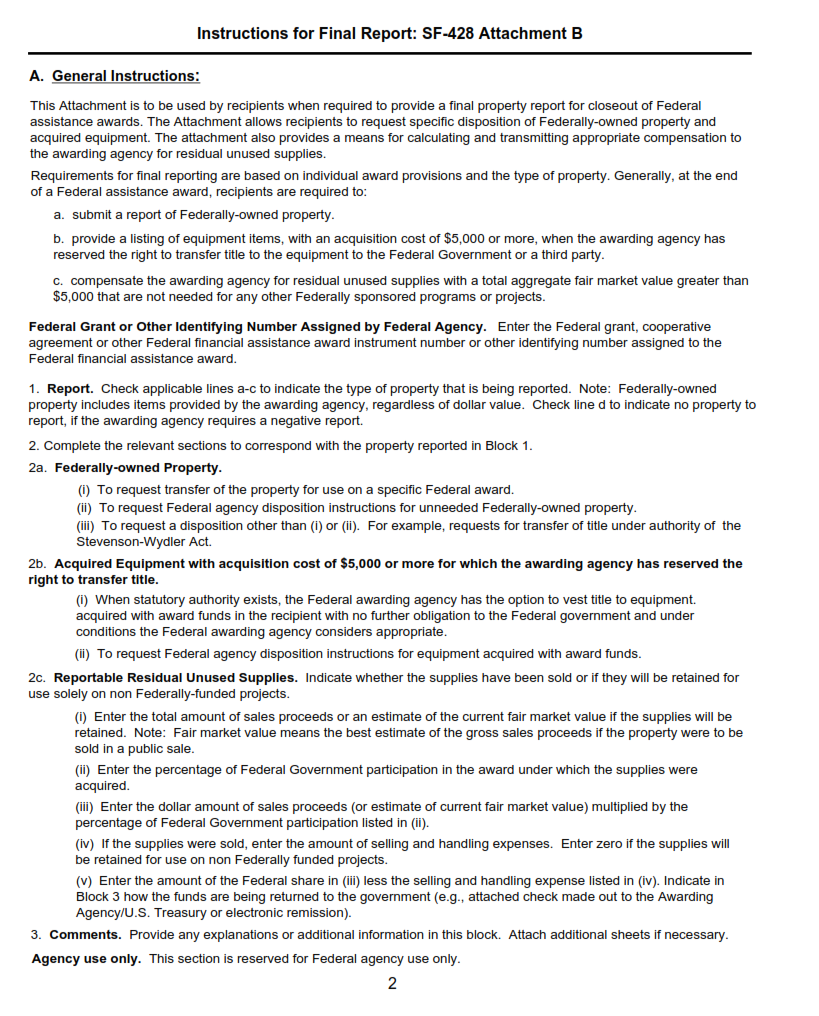

The SF 428B form, also known as the Tangible Personal Property Report, is a form used by federal agencies in the United States to report on their tangible personal property inventory. The report must be submitted annually to the General Services Administration (GSA) and serves as an important tool for ensuring accountability and transparency in the management of government property.

The SF 428B form requires that agencies provide detailed information about their tangible personal property holdings, including furniture, equipment, vehicles, and other assets. This information includes the location of each item, its condition and value, and any movements or transfers that have taken place during the reporting period.

In addition to providing information on each asset individually, agencies must also submit a summary report that provides an overview of their total inventory. This summary is used by GSA to track trends in government asset management and identify areas where improvements may be needed. Overall, the SF 428B form plays an important role in ensuring that taxpayer dollars are being spent responsibly and effectively.

What is the Purpose of SF 428B Form?

The SF 428B form is also known as the Tangible Personal Property Report or the Final Report. It is used by government agencies to report the final disposition of tangible personal property that has been purchased with federal funds and is no longer needed for project use. This form must be filed within 90 days after the project ends.

The purpose of this form is to ensure that all tangible personal property purchased with federal funds is accounted for and properly disposed of in accordance with federal regulations. The information provided on this form includes a description of each item, its original cost, current condition, and method of disposal.

Failing to submit an accurate SF 428B form can result in penalties and jeopardize eligibility for future federal funding opportunities. Therefore, it is crucial for government agencies to carefully complete this form and maintain accurate records of all tangible personal property purchased with federal funds throughout the lifecycle of a project.

Where Can I Find an SF 428B Form?

The SF 428B form is a Tangible Personal Property Report that has to be filed as the final report by a federal agency when they dispose of any tangible personal property. This form is used to document the complete disposal process of such property and helps in ensuring accountability and transparency. The SF 428B form requires details about the property, including its description, condition, value, and disposition method.

To find an SF 428B form, one can visit the official website of General Services Administration (GSA), which provides all necessary forms for federal agencies. The GSA website offers multiple options to access this form based on your requirements. You may either search for it using keywords like “SF 428B” or browse through their forms directory where you can select the relevant agency followed by the specific form number.

Apart from accessing the SF 428B form online, you can also contact your local GSA office or reach out to their help desk for assistance. Additionally, if you have any doubts regarding filling out this form or need guidance during the disposal process, GSA’s customer service team will be happy to assist you with any queries related to this topic.

SF 428B Form – Tangible Personal Property Report – Final Report

The SF 428B form is a Tangible Personal Property Report that serves as the Final Report of personal property owned by the Federal Government. This report is required to be submitted annually by all federal agencies and departments to the General Services Administration (GSA), which maintains an inventory of government-owned personal property.

The purpose of this report is to provide accurate information on tangible personal property and ensure proper utilization, management, and disposal of government-owned assets. It includes details such as item descriptions, acquisition costs, depreciation schedules, current values, location information, and usage data. The data gathered from this report helps in identifying redundant or underutilized equipment that can be disposed of or shared among agencies.

It is essential for federal agencies to submit these reports accurately and timely because it provides transparency and accountability in their handling of public resources. Failure to comply with reporting requirements may result in penalties or other legal consequences. In conclusion, the SF 428B form plays a crucial role in managing tangible personal property owned by the Federal Government efficiently and effectively.

SF 428B Form Example