SFFORMS.COM – SF 428S Form – Tangible Personal Property Report – Supplemental Sheet – If you own a business, chances are you have tangible personal property that needs to be reported for tax purposes. To help with this process, the state of Iowa requires business owners to file an SF 428S Form – Tangible Personal Property Report. This report provides information on all the physical assets owned by the business such as furniture, machinery, and equipment.

However, in some cases, additional information may be needed beyond what is provided on the standard SF 428S Form. That’s where the SF 428S Supplemental Sheet comes into play. This sheet allows businesses to provide more detailed information about their tangible personal property and helps ensure accurate reporting for tax purposes.

Download SF 428S Form – Tangible Personal Property Report – Supplemental Sheet

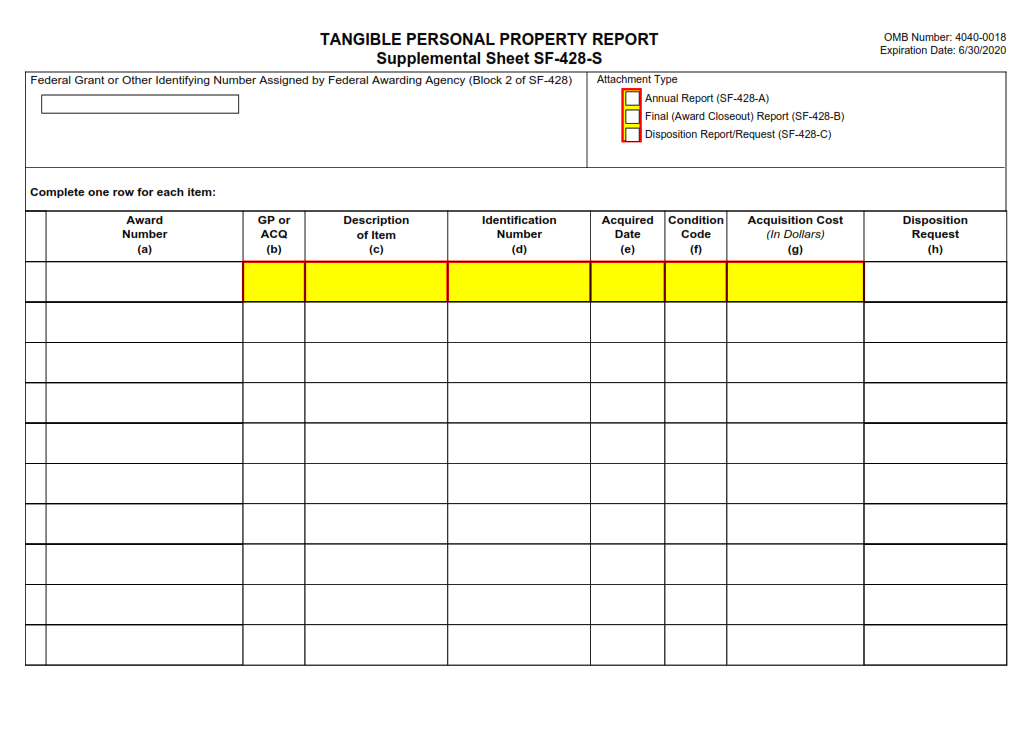

| Form Number | SF 428S Form |

| Form Title | Tangible Personal Property Report – Supplemental Sheet |

| File Size | 114 KB |

| Date | 06/2017 |

What is a SF 428S Form?

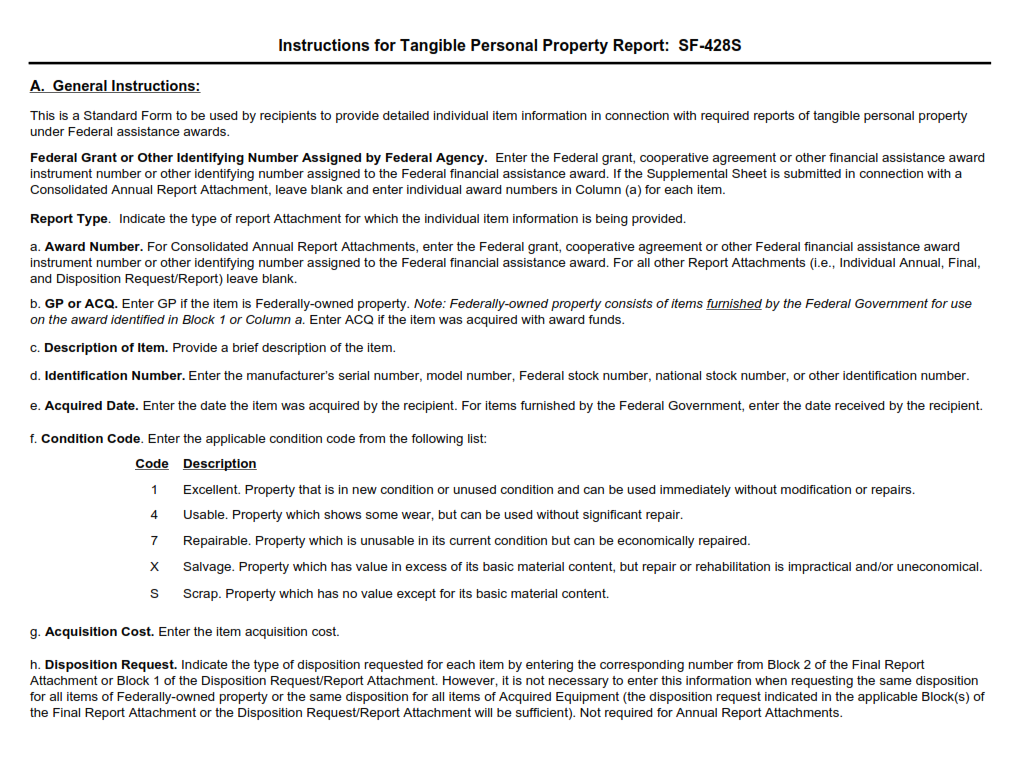

The SF 428S form, also known as the Tangible Personal Property Report Supplemental Sheet, is a document used by United States federal agencies to report information about tangible personal property. The form is typically used to provide additional information about high-value equipment, furniture, or other assets that are not included in the standard SF 428 form.

The SF 428S form is often required for federal grants and contracts where the recipient agency must track and report on all of their tangible personal property. This may include items such as computers, laboratory equipment, or vehicles. The supplemental sheet provides detailed descriptions of each item including its condition, location, acquisition date and cost.

It’s important that organizations fill out the SF 428S form accurately and completely since it serves as one way for government agencies to prevent fraud and ensure accountability throughout the grant process. Failure to provide complete information on this form could result in delays in processing payments or even loss of funding altogether.

What is the Purpose of SF 428S Form?

The SF 428S form is a supplemental sheet used in conjunction with the SF 428 form, also known as the Tangible Personal Property Report. The purpose of this form is to provide additional details about any tangible personal property owned by a government agency that was not disclosed on the original report. This could include items such as furniture, equipment, and vehicles that were acquired after the initial report was filed.

The SF 428S form is required to be filed annually by all government agencies in order to comply with federal regulations. It provides transparency and accountability for any tangible personal property owned by these agencies, which helps prevent fraud or misuse of government resources. Additionally, this information can be used for budgeting purposes and to determine if any surplus property can be sold or repurposed within the agency.

Overall, while completing the SF 428S form may seem like an extra administrative burden for government agencies, it serves an important purpose in maintaining transparency and accountability for all tangible personal property owned by these organizations.

Where Can I Find a SF 428S Form?

The SF 428S form is an essential document required for reporting tangible personal property. This form is a supplemental sheet to the SF 428 form and should be filed with the Department of the Treasury’s Bureau of the Fiscal Service. The purpose of this form is to provide additional information about items that are gifted or donated as part of a decedent’s estate.

To obtain this form, you can visit the official website of the U.S. government. You can also contact your local tax or revenue office, where they will be able to provide you with a copy of this document. It’s important to note that some states may have their own version of this form, so be sure to check with your state’s specific requirements before filing.

Once you have obtained a copy of the SF 428S form, it’s important to fill it out accurately and completely. Any errors or omissions could result in penalties or further complications down the line. If you’re unsure about how to fill out this form, consider consulting with a tax professional who specializes in estate planning and taxation.

SF 428S Form – Tangible Personal Property Report – Supplemental Sheet

The SF 428S Form, also known as the Tangible Personal Property Report – Supplemental Sheet, is an essential document used by businesses to report their tangible personal property assets. This form serves as a supplement to the SF 428 form and is required by most state and local governments for tax assessment purposes. The information provided in this form is crucial for determining the fair market value of a business’s assets.

The SF 428S Form requires businesses to provide detailed information on their tangible personal property, including machinery, equipment, furniture, fixtures, and other assets that are not classified as real estate. Businesses must list each asset separately and provide its acquisition cost, date of acquisition, depreciation method used, and current value. They must also indicate any changes in ownership or location of these assets during the reporting period.

As a copywriting assistant, it’s crucial to ensure that businesses understand the importance of accurately completing the SF 428S Form. Failure to provide complete and accurate information may result in penalties or fines from tax authorities. By working closely with clients to gather all necessary details on their tangible personal property assets and assisting them in completing this document correctly can help avoid potential legal issues down the line.

SF 428S Form Example